Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

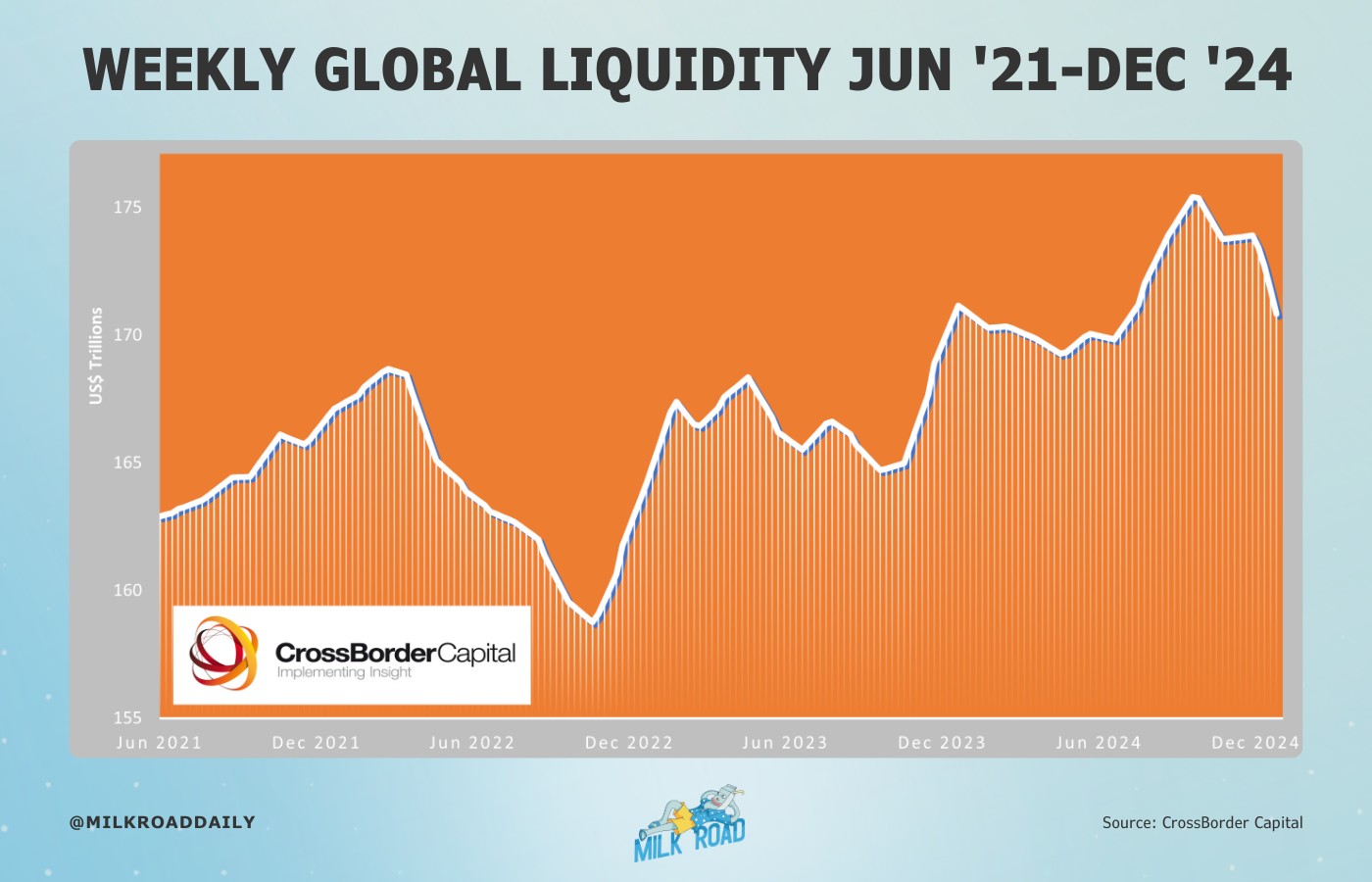

On liquidity

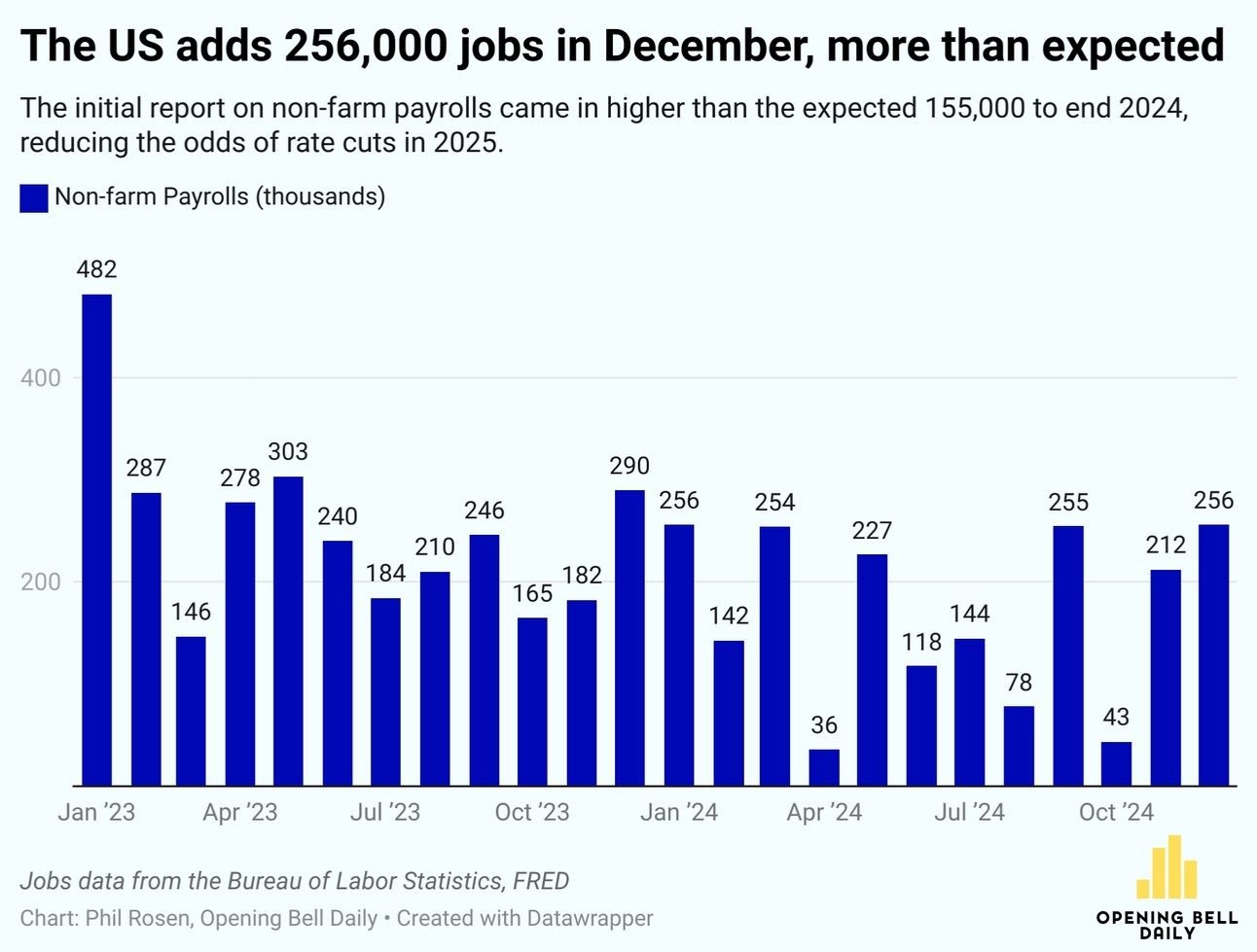

Global liquidity has been trending lower for now. A strong jobs report reduces the odds for rate cuts. On the other hand, since unemployment ticked lower to 4.1% vs 4.2% estimates, it shows we are yet to embark into the phase where unemployment starts to accelerate which often marks the start of recessions.

And we know assets such as stocks and bitcoin correlate highly with global liquidity.

The inverse correlation between yields on the 10-year Treasury and global liquidity is also pronounced.

It is a reflection of how global liquidity finds its way into US stocks and global markets in stocks, bonds, precious metals, Bitcoin, real estate, and hard assets.

- Contrasting Forces: While a decreasing M2 and global liquidity might be bearish for asset prices, stealth QE could counteract this by injecting liquidity into the system. The net effect would depend on which force is stronger or how these policies are perceived by the market.

- Market Reaction: If markets believe that stealth QE will continue to support asset prices, they might overlook the decreasing M2, focusing instead on the liquidity provided by covert monetary policies.

- Inflation and Interest Rates: If stealth QE leads to higher inflation expectations without a corresponding increase in official interest rates, this could indeed push Bitcoin and stocks higher, as investors look for assets that might outpace inflation plus liquidity tends to find its way into the strongest assets such as stocks and bitcoin.

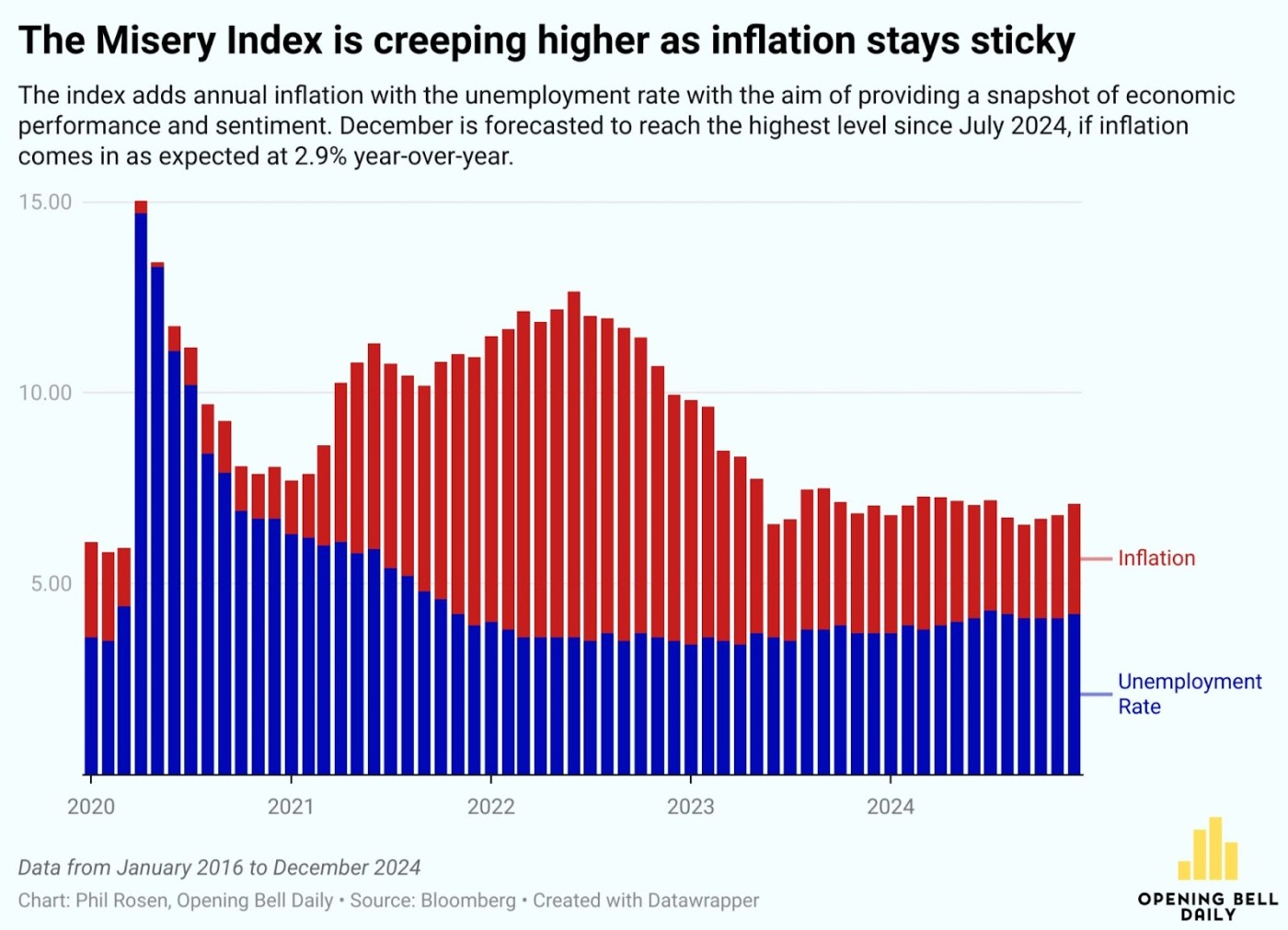

How can the Fed cut rates at a time when inflation remains stubbornly persistent while growth and jobs data shows resilience and strength?

In past cycles, the Fed would normally be standing pat or hiking rates, but the massive political pressure on keeping markets bullish forces the Fed's hand into remaining more dovish when they should be more hawkish. The record levels of debt and other unfunded liabilities also forces more stealth QE which further buoys markets, hard assets, and real estate, a consequence of the devaluation of fiat.

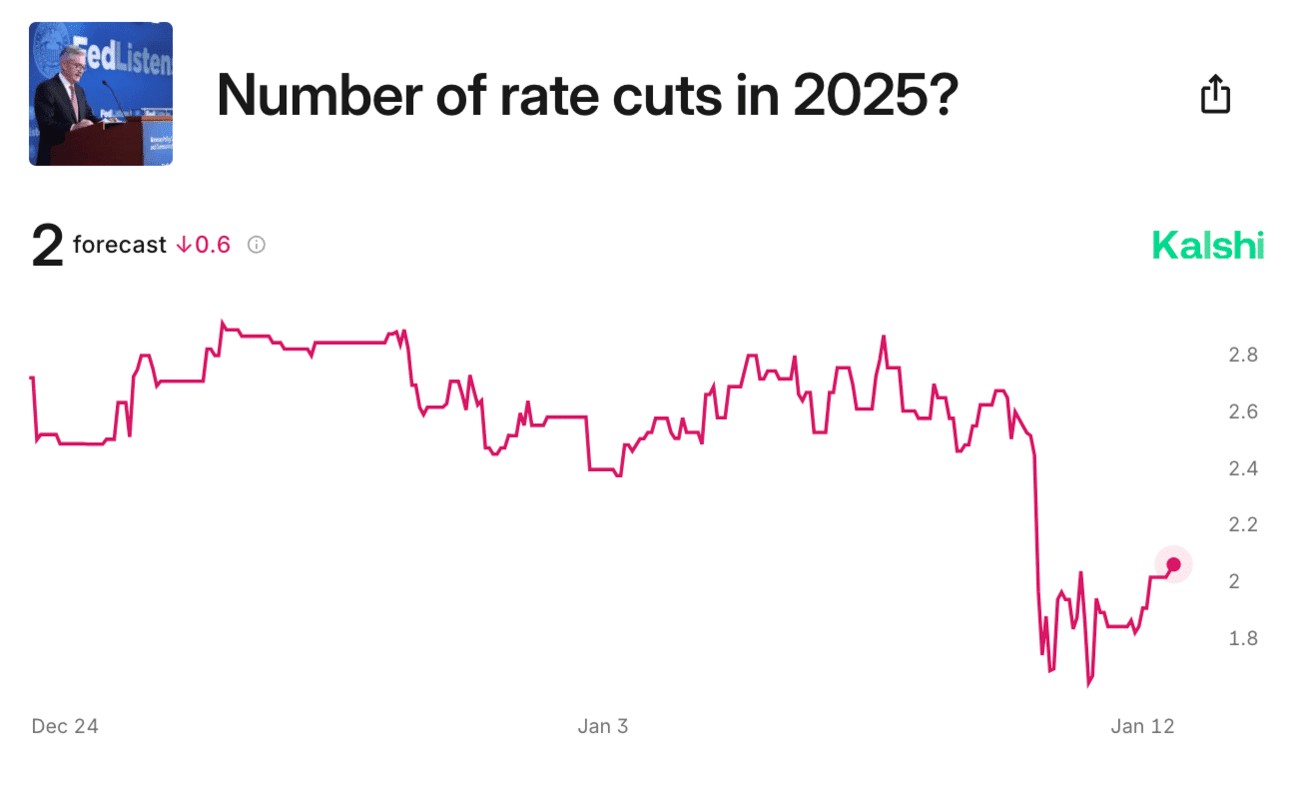

While the number of rate cuts in 2025 remains at 2 which belies CME FedWatch of just one rate cut, some analysts are starting to say they believe the rate cutting cycle is over.

Back in March 2020 when the Fed blasted markets with trillions of dollars worth of QE due to COVID. And in the second half of 2025, those debts will be coming due. So in order to refinance, the government will probably do something like print a metric ton of cash → pay those loans → lower interest rates → take out new loans at the lowered rates they just set.

It took about a year from March 2020 for inflation to start to soar. Given ongoing stealth QE along with rate cuts that have already happened, inflation may start to tick higher sooner than expected. This would create a hard spot for the Fed who wishes to sidestep recession as it would force the Fed to keep rates steady or even start hiking again depending on the CPI, PPI, and PCE inflationary data.

Indeed, a tug-o-war is being played out between this stealth form of QE which pushes markets but also inflation higher vs. reduced global liquidity due to interest rates that are not coming down as fast as expected due to inflationary concerns. The wildcard is productivity created by individuals and corporations using AI as it exponentially evolves which pushes GDP higher. This could result in a softer-than-expected landing further postponing recession even should inflation move higher. Expect more toppy or choppy markets ahead as the battle plays out.