Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

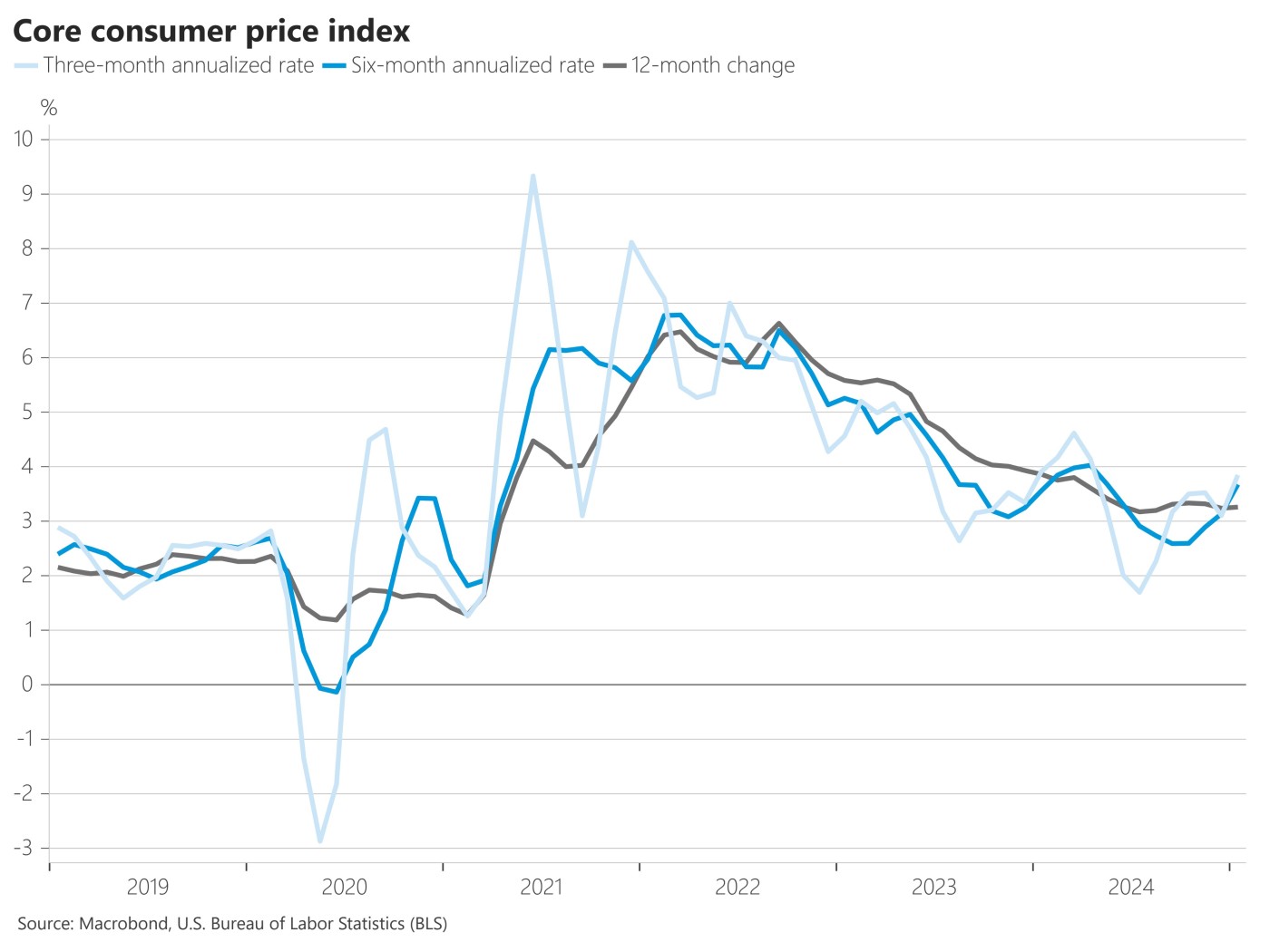

The core CPI MoM came in at 0.1% and YoY 0.2% above expectations. This is a strike against easier money because the odds of another rate cut drop. If inflation keeps ticking higher ahead of expectations, it may even force the Fed to hike. Both the core CPI's 3-mo and 6-mo annualized rate are moving higher.

Treasury yields on the long end which have been trending higher since last September also jumped.

Both the European Central Bank and Bank of England plan to continue to reduce rates.

- The ECB cut its deposit facility rate by 25 basis points to 2.75% marking its fifth rate reduction since mid-2024. This reflects efforts to address weak economic growth and ensure inflation stabilizes at its 2% medium-term target. Inflation in the Eurozone was at 2.5% in January 2025, slightly above target but broadly aligned with projections. Analysts expect the ECB to continue cutting rates gradually through the first half of 2025, with markets pricing in up to four additional reductions this year, potentially bringing the deposit rate closer to 2%.

- The BoE recently cut its base rate by 25 basis points to 4.5% marking its third rate cut in six months. This decision was also driven by sluggish economic growth. Analysts expect further rate cuts throughout 2025, with expectations of up to three additional reductions this year.

Thankfully, we have the Department of Government Efficiency (DOGE) working around the clock to stop wasteful government spending. But whether they can reduce wasteful spending sufficiently remains the question. For those who dont hold bitcoin, government debt is problematic. For those who do hold bitcoin, government debt is their greatest asset.

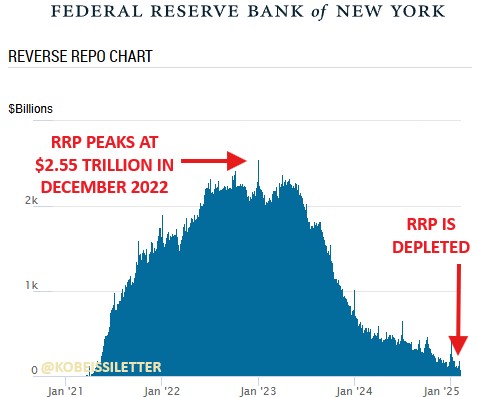

As the Fed prints to honor debt interest and other unfunded liabilities, the Fed's Reverse Repo Facility (RRP) is now down ~$2.5 TRILLION from its peak in December 2022. The US is borrowing so much debt to fund deficit spending that the RRP has been depleted to a major low.

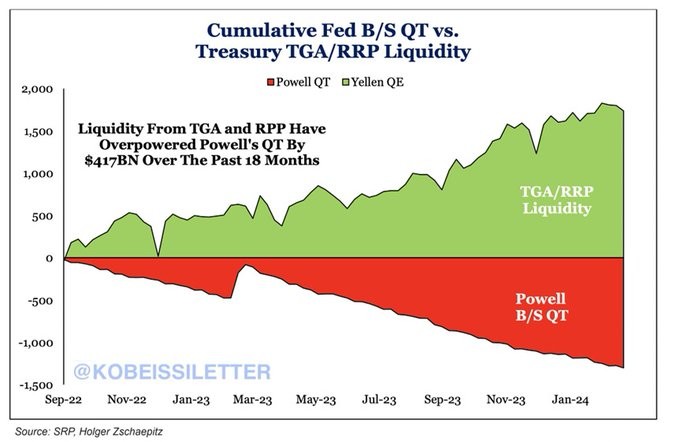

Deficit spending has become so large in the US that the US government has had to flood bond markets with supply in the form of stealth QE. Liquidity from the US Treasury and RRP has exceeded the Fed’s balance sheet reduction by $417 billion in 18 months.

Since $2.5 trillion has been depleted, it may mean that the end of Quantitative Tightening.

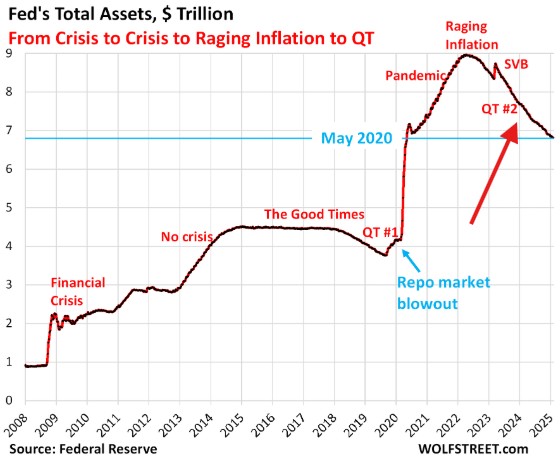

It also means that the US is issuing unprecedented levels of debt to fund deficit spending. In 2025, $9.2 TRILLION of US debt will either mature or need to be refinanced. The US holds $36.2 trillion of debt, meaning 25.4% of the total is set to mature. The average interest rate on US Treasury debt has risen to 3.2%, the highest since 2010. Rolling over such a large amount of debt at these rates will strain the budget and potentially crowd out other spending priorities. The Fed may have to use its Bank Term Funding Program to effectively inject liquidity into markets without formally expanding the Fed's balance sheet. The Fed can also shift toward issuing more short-term bills rather than long-term bonds can mimic QE by reducing interest rate pressures and increasing market liquidity. This will also pressure the Fed to lower rates.

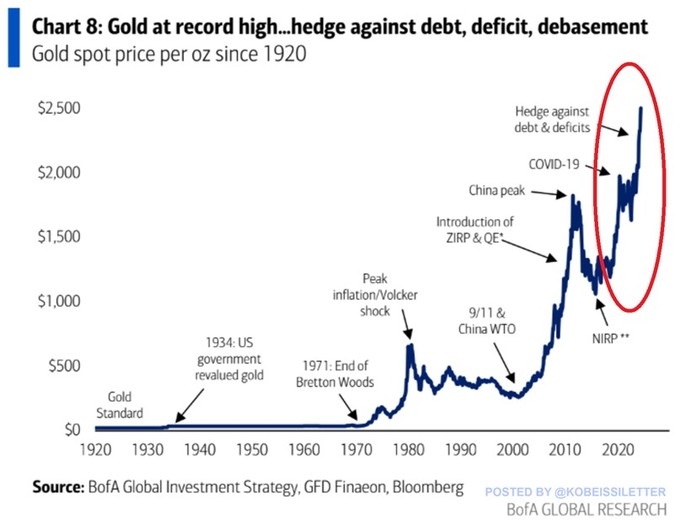

So with more stealth QE on the way, gold is pricing this in. Major markets may therefore resume their uptrends sooner than later.

Much of the recent run higher in Treasury yields was due to concerns over deficit spending but recently, DOGE announced that they are reducing government spending by at least $1 billion per day. Interestingly, after Inauguration and this announcement, Treasury yields fell 40+ bps.