by Dr. Chris Kacher

The pro-crypto administration comes into power alongside a Bitcoin-friendly Congress as well as pressure on Powell to lower rates. Further, during his campaign, Trump said he wanted to make the US the “crypto capital of the planet” and he floated the idea of a strategic bitcoin stockpile. Other governments will likely follow along and create their own stockpiles of Bitcoin to minimize the impact of inflation as QEndless devalues fiat.

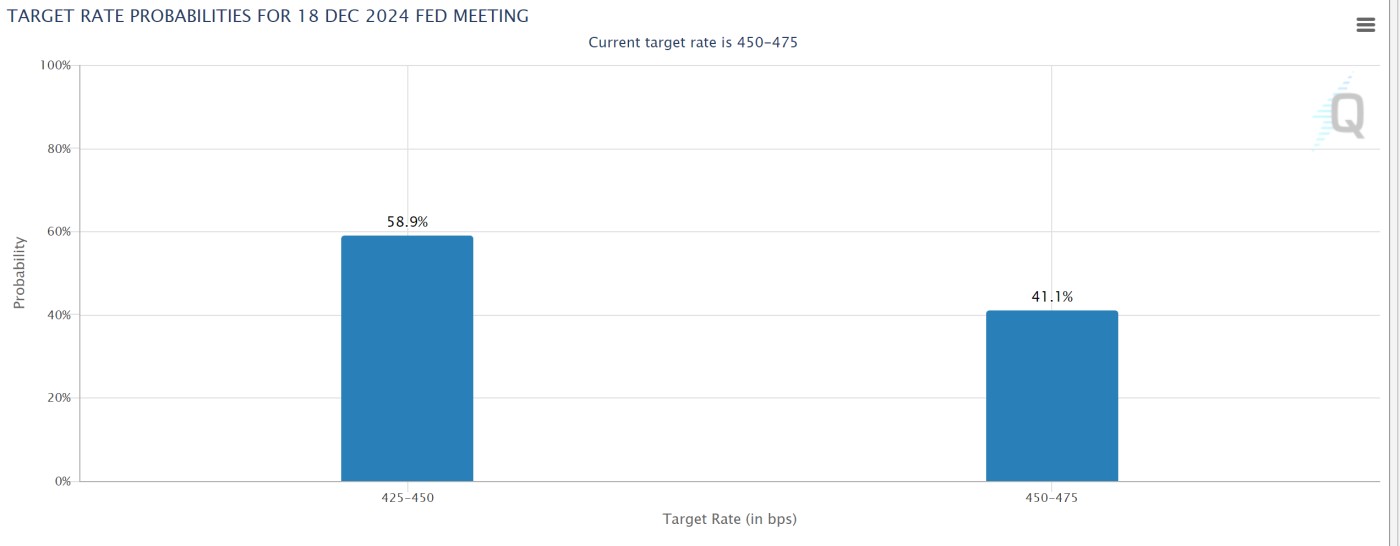

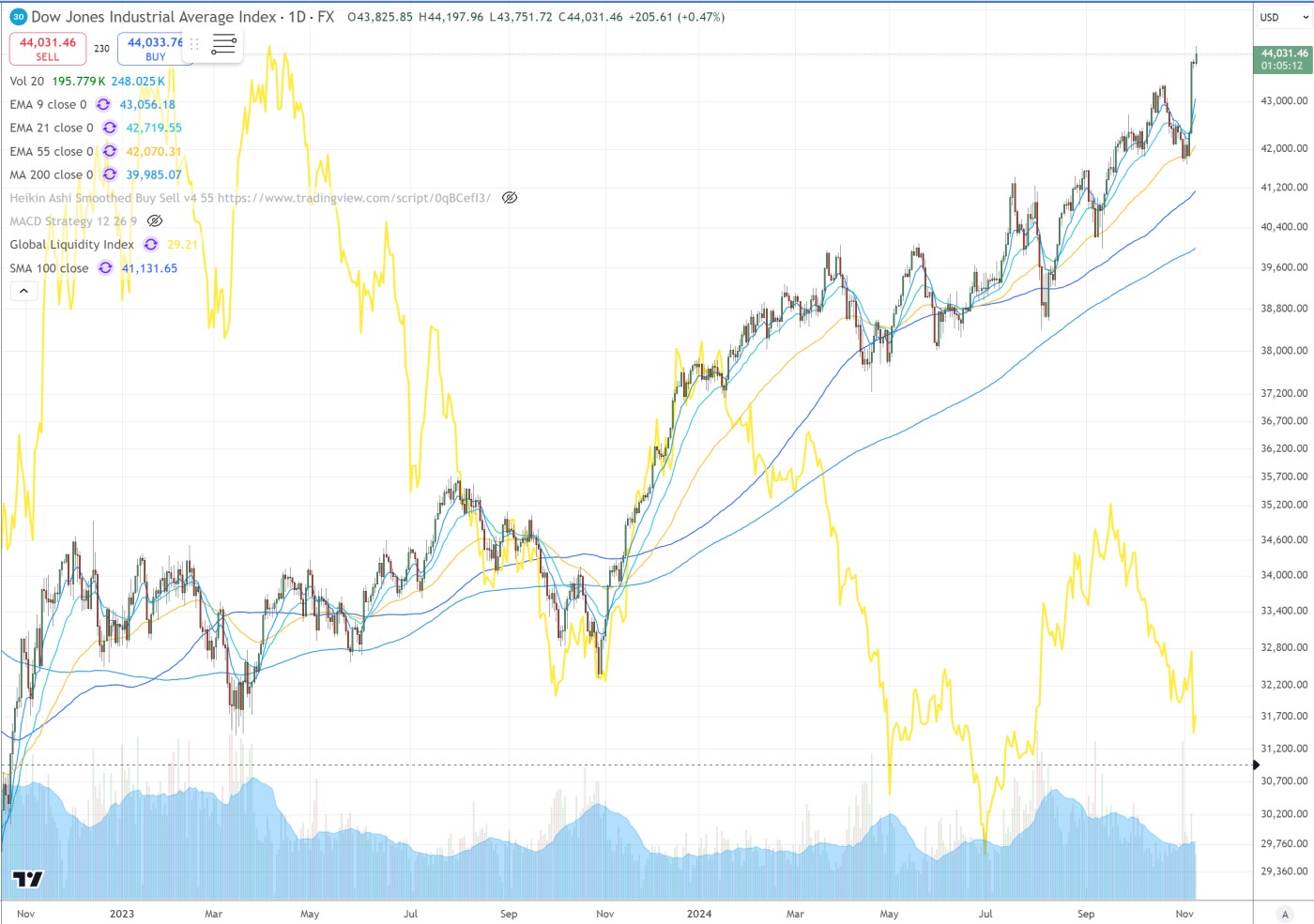

During Trump’s first administration, he regularly pointed to the strong stock market as an indicator of his performance as president. This suggests Trump will do whatever he can to make the stock market go up, another tailwind for Bitcoin, as lower rates and QEndless make for higher markets since QE was launched in late 2008.

But will Trump’s administration spur economic growth with pro-business policies without triggering inflation given the continual expansion of QE? Massive productivity from cutting edge tech along with aggressive government spending cuts could be the winning edge.

Vivek Ramaswamy and Elon Musk have been appointed to lead the newly created Department of Government Efficiency (DOGE). It will ruthlessly slash government waste and force more intelligent spending of taxpayer dollars.

If you are looking for concrete plans of action, Elon tweeted, “All actions of the Department of Government Efficiency will be posted online for maximum transparency. Anytime the public thinks we are cutting something important or not cutting something wasteful, just let us know! We will also have a leaderboard for most insanely dumb spending of your tax dollars. This will be both extremely tragic and extremely entertaining.”

Germany goes nuclear?Over in the EU, in a major political shift, Germany's coalition government has collapsed after Chancellor Olaf Scholz fired Finance Minister Christian Lindner from the Free Democrats (FDP). This collapse raises concerns about political stability in Germany which now look like they will hold early elections in February, rather than waiting until September 2025. Current polls suggest the CDU (Christian Democratic Union) has the best chance of winning which has called for a reversal of Germany's nuclear phase-out. This could lead to a broader realignment of German political parties and their policy positions.

The pro-nuclear stance of the CDU is in parallel with the growing interest among institutional and large private investors in nuclear energy as evidenced by the launch of the Triton fund, which focuses on uranium mining and nuclear-related investments. Institutional investors looking for stable, long-term investments may find nuclear energy appealing due to its potential for high returns and its strategic importance in energy security.

This could have a net effect of easier money policies out of the ECB which will help push markets higher. This will also help contribute to the outperformance in nuclear power stocks overall since major governments are finally waking up and understanding that today's nuclear energy is created by power plants that are safe while also being green and substantially more economic than other forms of energy such as wind, solar, and coal. Studies estimate that coal-related air pollution contributes to approximately 50,000 deaths annually in the United States alone. Globally, coal is responsible for millions of premature deaths due to air quality degradation. It's high time nuclear took center stage as the decades of disinformation comes to an end. That say, it will take some years before nuclear power plant technology takes hold as the tech is being built then will be deployed. In the meantime, nuclear power/uranium stocks are benefiting from expectations.