Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

Global liquidity

The traditional measure of liquidity (Fed's total assets - TGA Balances - RRP balances) in the US as represented by the red line shows sideways action.

But global liquidity is at $175 tr (nearly 60x bigger) because it is dominated in size by the private sector. Further, the trend in rates is down as central banks rachet down their respective rates well into next year. Of course, should a bout of a sustained uptrend in inflation come sooner than expected, all bets are off. But it can take several months or longer for inflation to show much as it took until early 2022 for inflation to rise after the bout of money printing that started in March 2020. So markets may still have a good window well into next year before rates have to rise once again.

Over in the UK, the BOE governor expects four UK rate cuts next year as inflation eases. This underscores the EU's position on their continuation of rate cuts down to 2% by the end of 2025 and the US down to 3.25-3.5% by Q1 2026. In consequence, this helps the US dollar maintain its uptrend against these currencies.

Jobs data

Over in the jobs arena, concern that the U.S. and other countries are systematically overstating job creation based on questionable assumptions, more downward revisions are likely. Still, the prior major downward revision barely caused the stock market to flinch before regaining its upward momentum.

Trump's tough trade tariff agenda together with concerns about Trump having appointed Scott Bessent as treasury secretary who is a known hawk are potential headwinds. So despite Trump wanting lower rates, monetary policy may not ease as quickly. But Bessent wants a weak dollar so will likely print. Bessent's stance on the dollar is nuanced:

- Bessent emphasizes "maintaining the status of the dollar as the world's reserve currency," which typically requires a relatively strong dollar.

- However, he recognizes that a strong dollar can be harmful to U.S. manufacturing competitiveness, especially at the beginning of Trump's potential second term.

- Bessent views the dollar's reserve currency status as a powerful tool for wielding U.S. influence on the world stage, particularly through sanctions and financial leverage.

- He understands that "saving the US dollar likely means weakening it significantly," as a strong dollar doesn't work well for much of the world and won't rebalance the global order.

A weaker dollar into early next year that reverses the current trend in anticipation of the new administration together with continued stealth QE from the Fed suggest overall higher markets.

Altcoins just getting started (again)

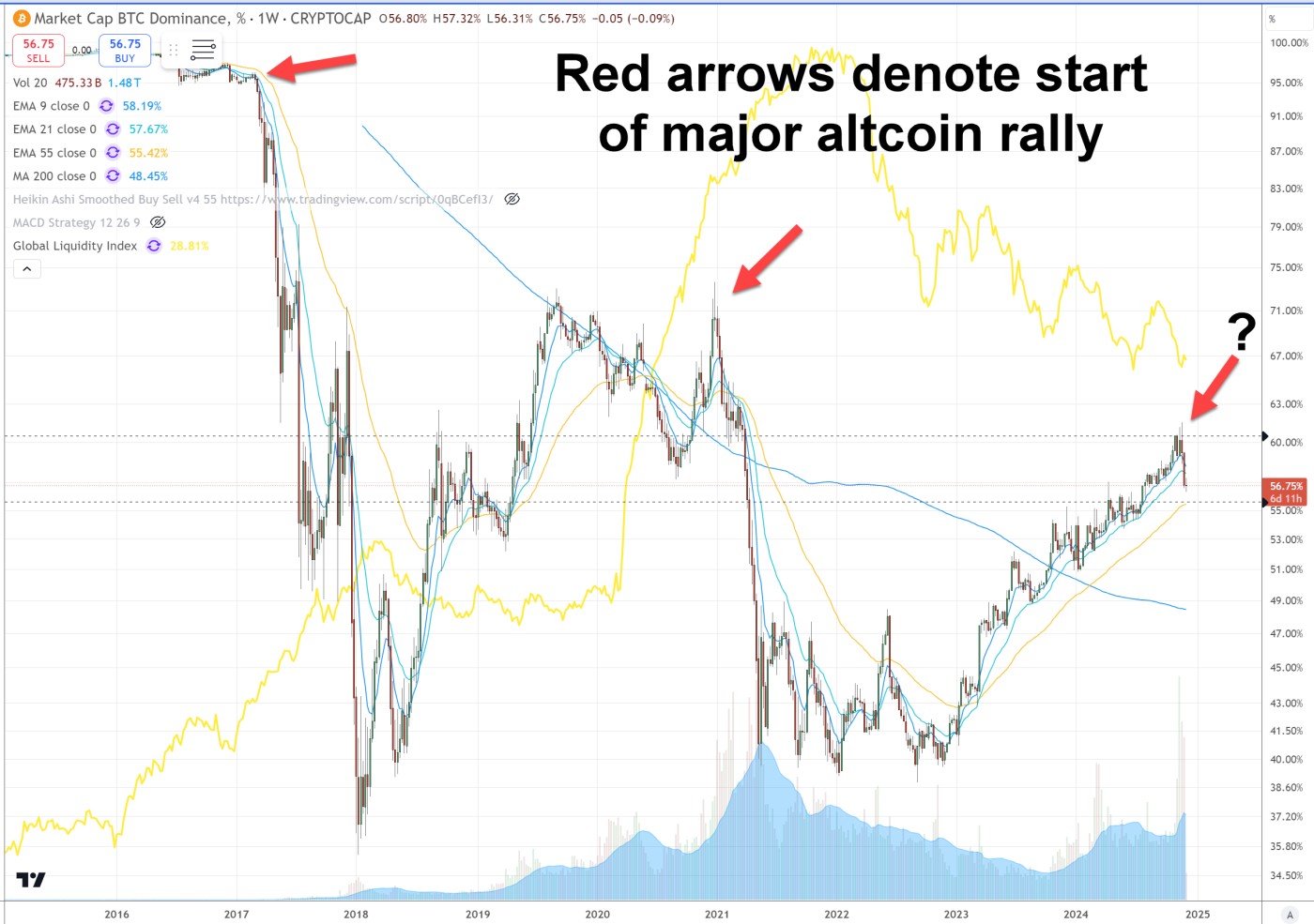

Bitcoin's market cap broke out a few weeks ago.

For altcoin season to really kick in, Bitcoin's market dominance in prior cycles topped. It may have topped just over the last couple of weeks. Indeed, a number of altcoins have sparked signs of life.

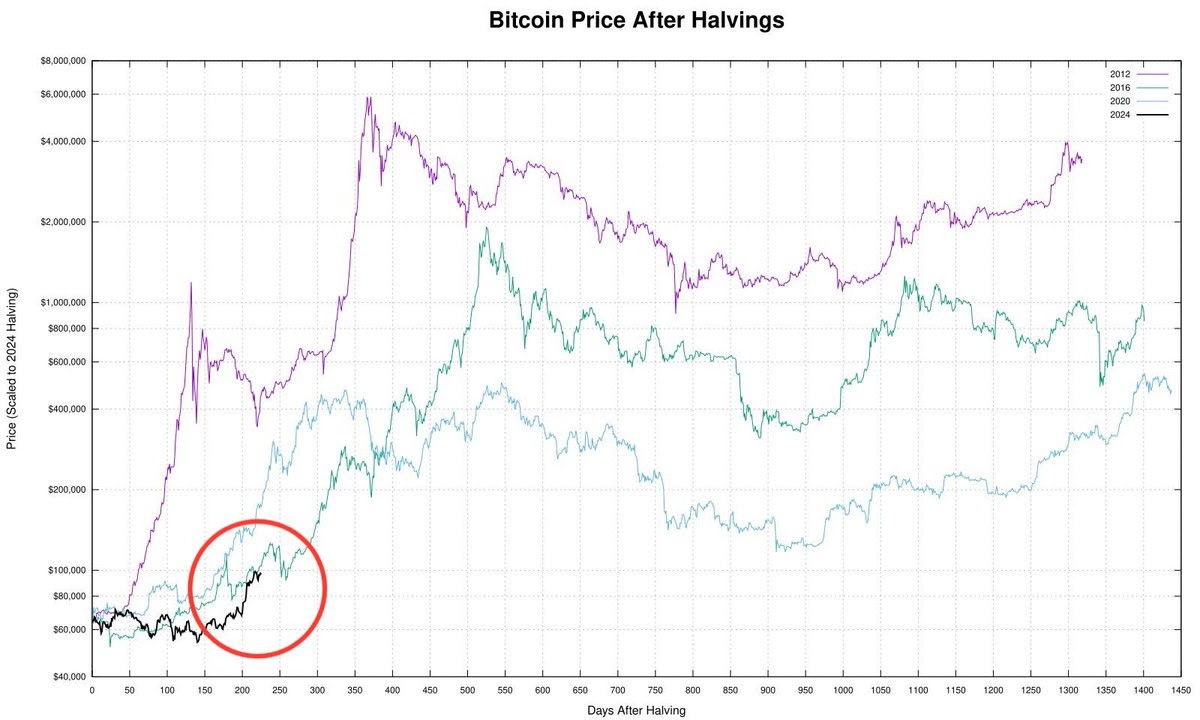

The black line shows where Bitcoin currently stands after its halving. Prior halvings sustained strong uptrends for many months. What could derail history? 1) Black swans of a nuclear war nature, 2) Surging inflation, 3) Recession. 1) holds low probability, 2) was discussed above so markets may yet have several months, and 3) remains unlikely for now as the economy so far is showing sufficient strength, doctored or otherwise.

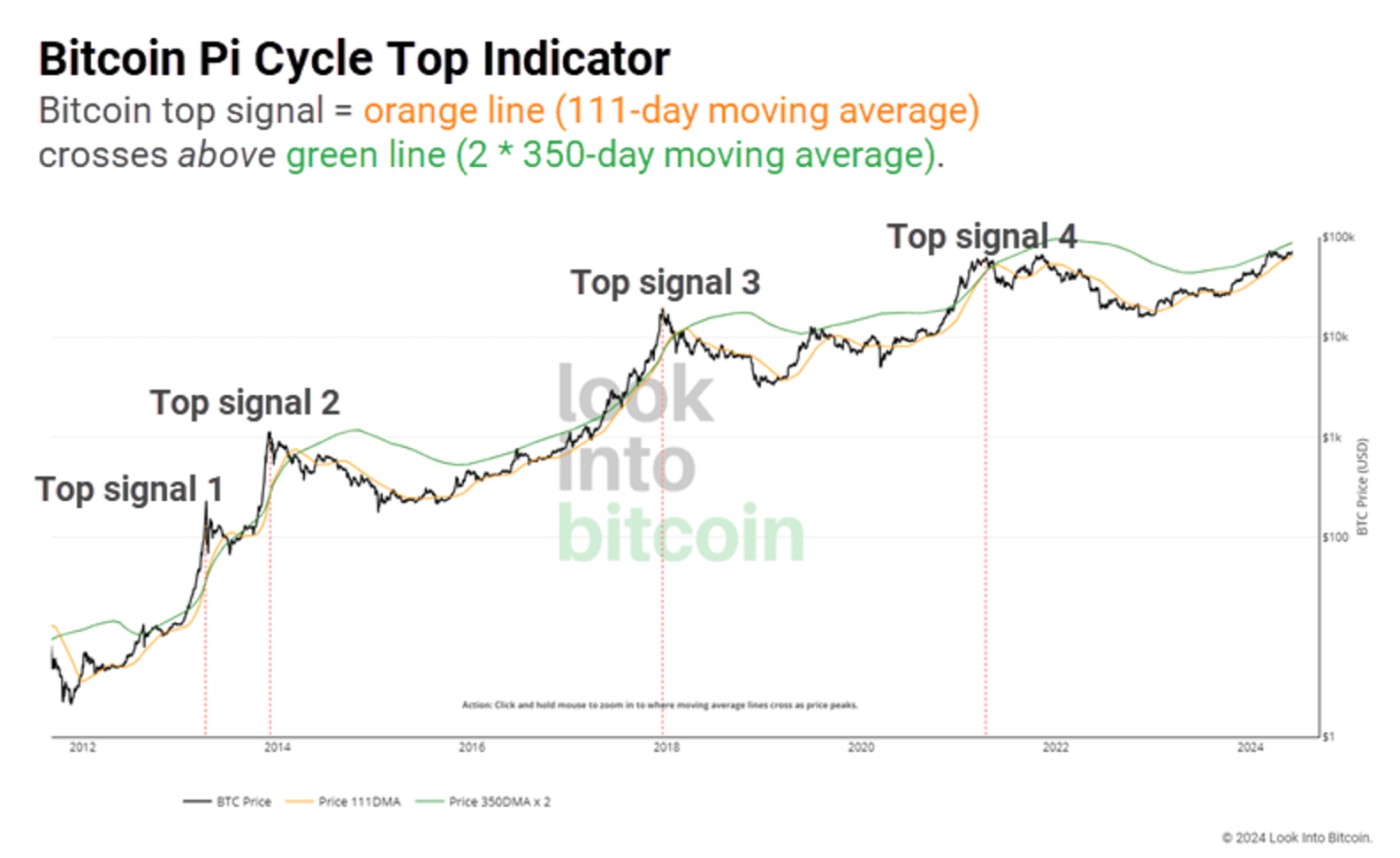

Bitcoin's pi cycle top indicator occurs when the orange line crosses above the green line. It looks to be at least several months away based on past cycles.