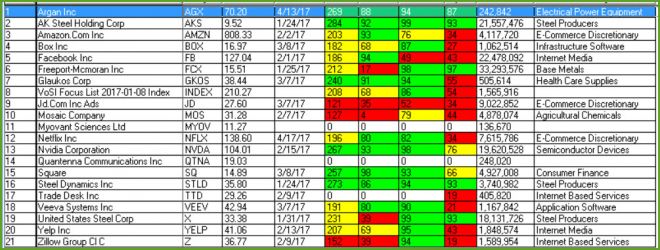

Current VoSI Focus List

The VoSI Focus List is a compilation and reference list of stocks for which Pocket Pivot or Buyable Gap-Up Reports have been issued. It is not intended as a "buy list" or a list of immediately actionable recommendations. Stocks on the list may or may not be in proper buy positions, and investors should exercise discretion and proper judgement in determining when and where stocks on the Focus List can be purchased. The following notes are intended to assist in this process. Please note that members can enlarge the Focus List image by clicking on the body of the email and then holding the Control Key while pressing the "+" key until it is large enough to read.

Removed From the List this Week: Both Airnet (ANET) and SunCoke Energy (SXC) from the list this past week ANET gapped down through its 50-day moving average on huge volume, an immediate sell signal for anyone long the stock at the time. SXC, which had already technically violated its 50-day moving average but was holding along the lows of a base, finally broke below the lows of the base on heavy volume. It was, however, already issuing highly cautionary signs.

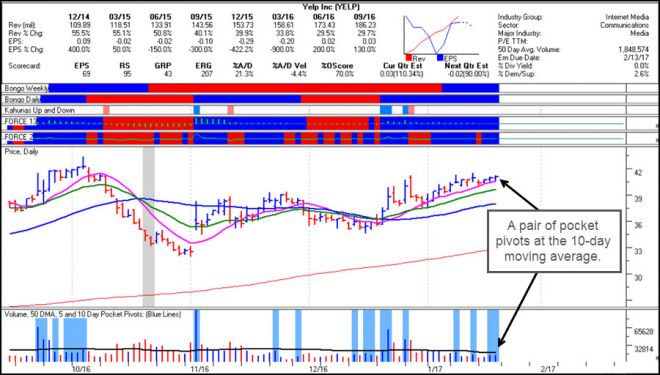

General Observations: We added Yelp (YELP) to our Focus List this past week by virtue of emailing a Pocket Pivot Report to members on Friday morning. The stock then went on to post another pocket pivot, its second in two days along the 10-day moving average. YELP is expected to announce earnings on February 9th.

Steel names AKS Steel (AKS) and Steel Dynamics (STLD) are expected to announce earnings this week, along with copper name Freeport McMoRan (FCX). The steels, including U.S. Steel (X), expected to announce on January 31st, are all wavering at support, with AKS on the verge of potentially violating its 50-day moving average as it sits just below the line.

STLD and X are sitting on top of their 50-day lines after flashing pocket pivots on Wednesday that went nowhere. FCX is holding along its 10-day moving average and looks the most constructive from a technical perspective as it builds a small cup-with-handle formation. We would hold off on initiating new positions in these names until the earnings picture has cleared up. Playing "earnings roulette" when you have no profit cushion is dangerous and generally not advisable.

Argan (AGX) is building a base after an initial upleg since we first put it on the list back on November 10th. We would use a violation of the 50-day moving average as a maximum selling guide, based on the Seven-Week Rule. More aggressive swing-traders may have already taken profits and are waiting for a possible pocket pivot to develop within the base to re-initiate positions.

Box (BOX) is well-extended, while Amazon.com (AMZN), and Facebook (FB) have formed one-week handles in potential cup-with-handle formations. Both AMZN and FB were buyable lower on roundabout pocket pivots when they regained their 50-day moving averages two weeks ago.

Glaukos (GKOS) appears to be building a cup-with-handle formation and is holding around its 10-day moving average. We would watch for potential low-volume action along the 10-day or 20-day moving averages as low-risk entry opportunities.

JD.com (JD) is extended and at the highs of its current price range. Note that Alibaba (BABA), which is not on our Focus List, is expected to announce earnings Wednesday before the open, and as a fellow Chinese e-commerce name, JD could move in sympathy.

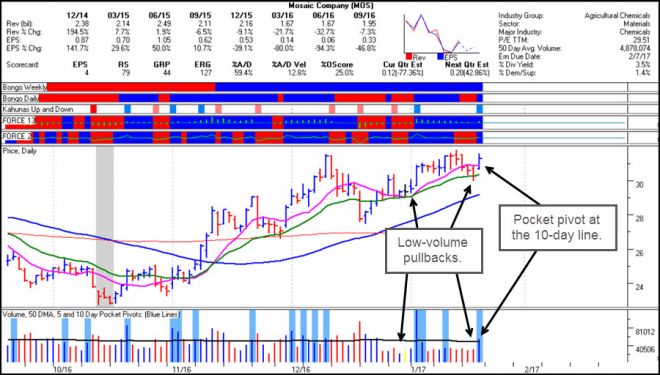

Mosaic (MOS) posted a pocket pivot at its 10-day moving average on Friday on above-average volume. The stock has acted well but in a choppy manner, and for this reason we prefer to look at entering on constructive weakness. One can see from the chart below that the stock has offered several low-volume pullbacks within the pattern, so it is these types of pullbacks we would look for in MOS as possible lower-risk entry opportunities.

Myovant Sciences (MYOV) does not appear to be offering any buy points within the pattern currently. Note that most upside moves occurring after pocket pivots have been fleeting, leading to very brief, but very sharp upside moves that are best described as "one-day wonder trades."

Netflix (NFLX) posted a buyable gap-up move on Thursday, using the 138.25 intraday low of the BGU day, plus an additional 1-3% of downside "porosity," as a tight selling guide. What intrigues us about NFLX is that this latest BGU also constitutes a clean breakout from a 17-month consolidation. This can have longer-term implications, so is constructive IF this current BGU holds up.

Nvidia (NVDA) continues to hold along its 20-day moving average. While last month's climactic, short-term peak can be viewed as a near-term sell signal, we have not removed the stock from the Focus List because we believe it has a reasonable chance of building a new base. Because the stock has obeyed the 50-day moving average since we first added it to the Focus List in early April 2016 at 35.80, we would continue to use that as a maximum selling guide based on the Seven-Week Rule.

Quantenna (QTNA) is back at its 50-day and 10-week moving averages on the daily and weekly charts. This could present a very low-risk entry opportunity. However, the fact that the stock had a huge 20%-plus move right after we added it to the Focus List as a pocket pivot buy on January 4th and has since retraced that entire move does not speak well for the stock. If it cannot hold the 50-day line it will be removed from the list.

Square (SQ) is holding tight along its 10-day moving average. We consider low-volume pullbacks to the 20-day line as preferred lower-risk entry points.

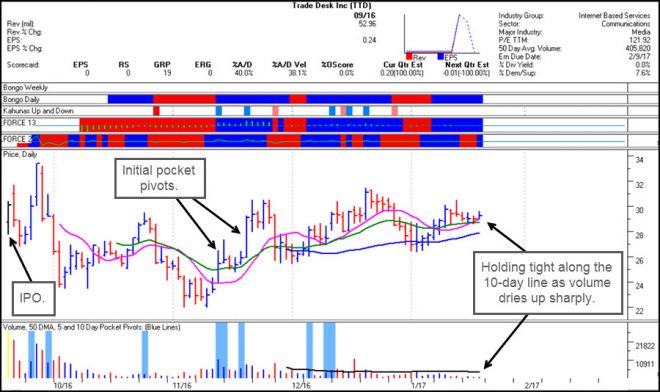

The Trade Desk (TTD) continues to act well, but it has not made any significant price progress since we initially added on the basis of pocket pivot action it had back in November. It has best been bought on constructive weakness, and two weeks ago in our Focus List Review Market Lab Report we suggested that the stock might be buyable in opportunistic fashion as it was holding along its 50-day moving average as it builds what is essentially its first base since coming public back in September of last year.

That led to an upside move from there, and TTD is attempting to tighten up here along the 10-day moving average as well as the 20-day exponential moving average (note that whenever we refer to a "20-day moving average" we are referring to the exponential moving average) as volume dries up in the extreme. This may offer another lower-risk entry point, using the 50-day line as a maximum selling guide. Note that TTD tends to be volatile because it is a small cap name trading just over 400,000 shares a day.

Veeva Systems (VEEV) has pulled into the confluence of its 20-day and 50-day moving averages on extremely low "voodoo" volume levels. This puts it in a lower-risk entry position using the 50-day line as a selling guide.

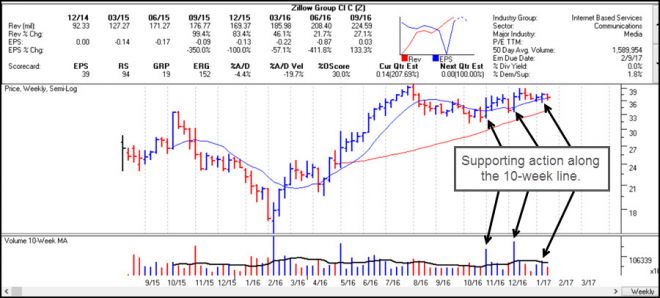

Last but not least Zillow (Z) is working on what is now a 26-week cup-with-handle base. The handle is now five weeks in duration, and the stock has proven to be buyable along the 50-day and 10-week moving averages on its respective daily and weekly charts. However, no breakout has occurred yet. Note, however, that Z has shown strong weekly volume supporting action as it has built the right side of this cup-with-handle formation.

Charts used in this Market Lab Report are courtesy of High Growth Stock Investor Software, LLC, Copyright 2017, used by permission. HGSI offers a number of built-in screens and chart views based on our work, and they are often featured in our reports.