Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

Corporate Bitcoin

There’s a growing number of global companies that are following Michael Saylor's strategy of putting Bitcoin on the balance sheets of his company Microstrategy (MSTR). We mentioned MSTR to members a number of times, most recently in September where we mentioned MSTR was showing price strength which would be underscored by Bitcoin's clearing of its 200-dma.

Other companies are doing similar such as Metaplanet which now holds $108M worth of $BTC. A private company called Oasis Engineering is putting 25% of their annual profits into Bitcoin. Trump's administration plans to make Bitcoin part of the national treasury. Other governments are likely to follow suit.

In summary:

- MicroStrategy's success with Bitcoin investment is seen as a catalyst for wider corporate adoption.

- The strategy involves converting fiat capital into Bitcoin to attract yield-seeking investors.

- Other companies, like Semler Scientific, are adopting similar strategies and seeing significant stock price increases.

- This trend creates a network effect, where more companies joining "Team Bitcoin" collectively increase the value of their holdings.

- MicroStrategy has become the 93rd largest US company by market cap through this strategy.

- Adopting Bitcoin is becoming a necessity for financial survival and growth for corporations, individuals, and countries.

- A dramatic repricing of Bitcoin to "millions per coin" will take place when this strategy reaches a tipping point of broad understanding and adoption.

- The influx of fiat capital into the limited supply of available Bitcoin is expected to create a revolutionary shift in financial markets.

| Company | Ticker | Market Cap ($B) | Bitcoin Holdings | Value ($B) | Value-to-Market Cap Ratio |

|---|---|---|---|---|---|

| MicroStrategy | MSTR | 86 | 331,200 | 31.1 | 0.362 |

| Tesla | TSLA | 1010 | $1.5B | ~1.5 | ~0.00148 |

| Block | SQ | 55 | ~8,027 | ~0.749 | ~0.0136 |

| Coinbase | COIN | 14 | 9,000 | ~0.837 | ~0.0597 |

| CleanSpark | CLSK | 3.6 | 8,701 | ~0.810 | ~0.225 |

| Galaxy Digital | GLXY | 5.94 | 8,100 | ~0.754 | ~0.127 |

| Stone Ridge | N/A | N/A | >10,000 | ~930M | N/A |

| Hut 8 Mining Corp | HUT | 1 | 8,000 | ~744M | ~0.744 |

| Riot Platforms | RIOT | 1.5 | 7,200 | ~669M | ~0.446 |

| Meitu | 1357.HK | 1 | 17,999 | ~1.67 | ~1.67 |

| MARA | MARA | 6.69 | 34,794 | ~3.3 | ~0.493 |

These companies represent a growing trend of corporate Bitcoin adoption, with many viewing it as a hedge against inflation or a long-term store of value.

Companies with higher BTC-to-market cap ratios such as HUT stand to benefit greatly as BTC rises in price.

Government Bitcoin

Elon Musk and Vivek Ramaswamy's Plan to reduce the size and scope of the US federal bureaucracy by July 4, 2026 could save half a trillion annually. I would add that the US government should buy Bitcoin with the funds saved.

EU interest rate trends

While the US fed drives interest rate trends for much of the world, the EU underscores these moves. Odds of a 50 bps rate cut in Dec-2024 jumped to 50% from 20% after PMI data. Traders are pricing in 150 bps in ECB rate cuts in 2025. Since rates of major countries correlate to a good extent, it is good to stay alert to any deviation from the general trend of rate reductions.

World wars

President Biden's administration made a significant policy shift by allowing Ukraine to use US-supplied long-range missiles to strike targets inside Russia. This move escalates the situation between Ukraine and Russia. Biden left Trump with a grinf*ck, leaving him with a horrible hand.

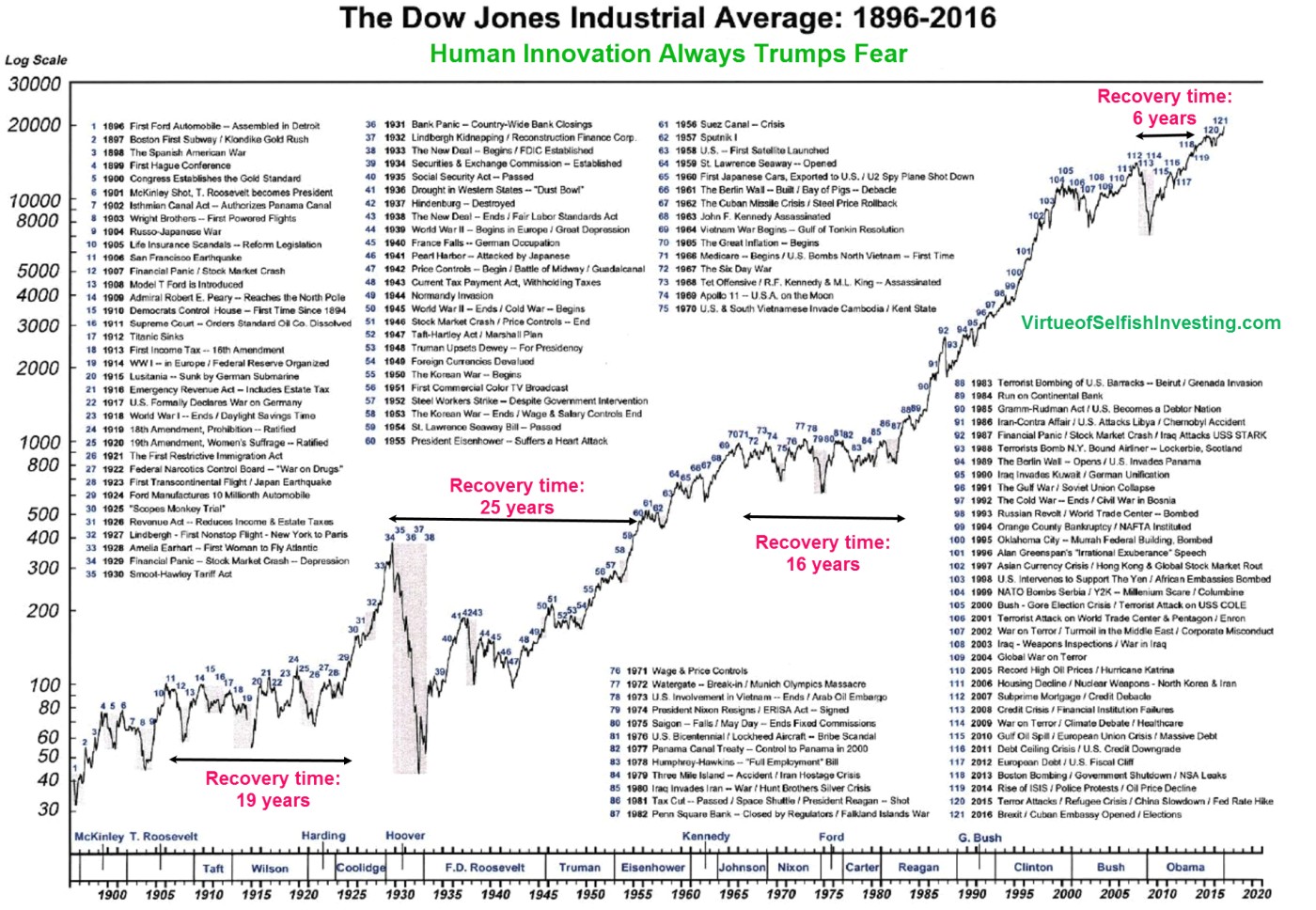

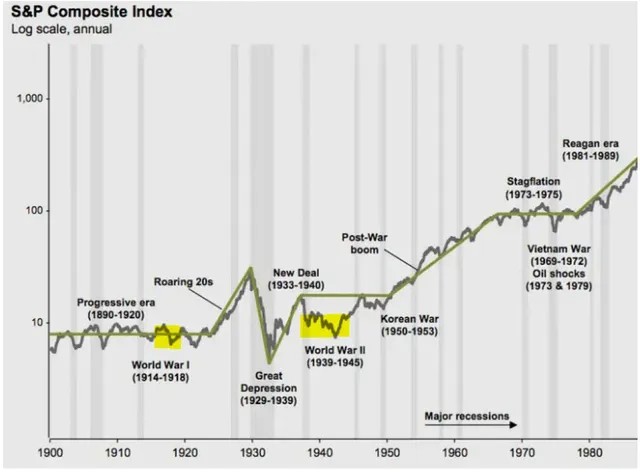

With the world closer to a third world war than since WW2 ended, I have examined markets prior to both world wars.

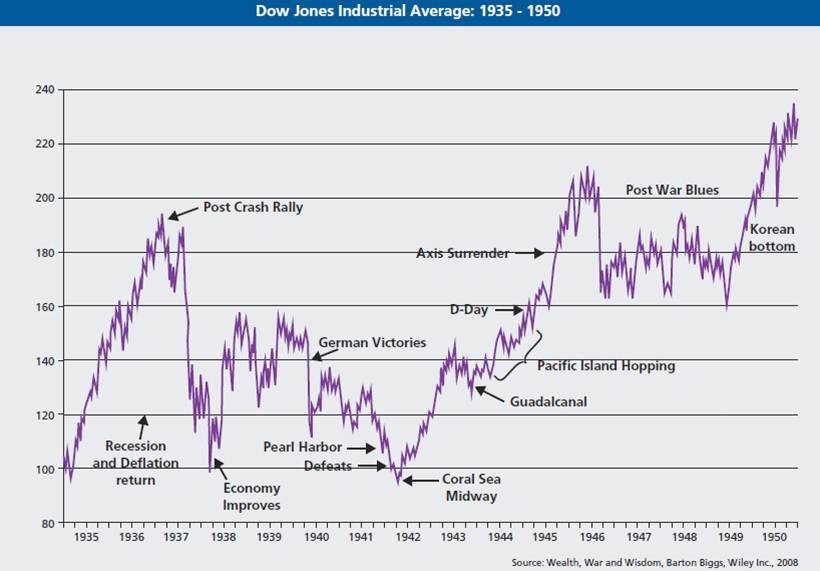

The Dow Jones Industrials were closed at the start of WW1 (July 28, 1914 - Nov 11, 1919) then reopened in Dec-1914 down -23.9% from where it was closed, but then had a strong rally that persisted until late 1916.

Prior to the US entering WW2 (Sep 1, 1939 – Sep 2, 1945) in Dec-1941, US markets were weak and volatile. US markets then had a strong and persistent rally that started a few months after Pearl Harbor (Dec 7, 1941).

In the present time, we are currently at the point where war is potentially expanding while the US only indirectly participates so this has and could continue to cause pullbacks such as when Israel attacks Iran and vice-versa. With global liquidity on the rise spurred by lower rates, such pullbacks are likely short-lived thus are buying opportunities for the intermediate term investor.