Market Lab Report

by Dr. Chris Kacher

The Web3 Evolution Will Not Be Centralized™

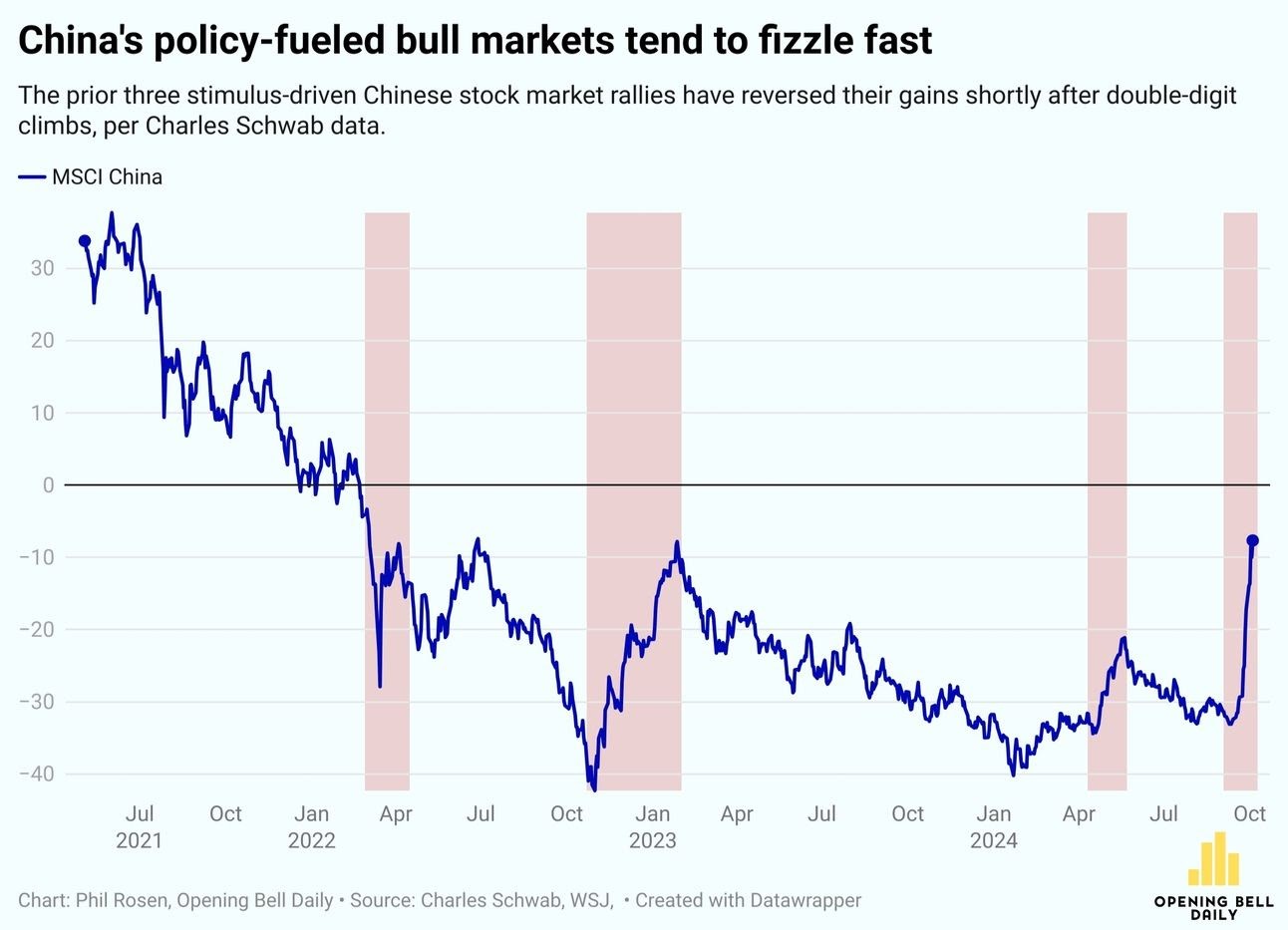

In the last week of September, Chinese stocks added almost $2 trillion of market value. But expect volatility to accompany the fast rocket ride. On Tuesday, the Hong Kong 50 Index lost as much as 10% after shooting higher by about 35% over the prior days. Note how the blast of Chinese QE in the fourth quarter of 2022 pushed U.S. stocks and Bitcoin higher as well though it took several weeks for Chinese QE to spill over into these other markets. This was helped by other central banks which joined in shortly thereafter as denoted by the yellow line in the upper chart.

So with the current easy money policy across central banks, a resumption of major market uptrends could occur. Keep in mind that bull markets triggered by past China stimulus ended quickly once stimulus ended but this did not stop the QE money train from lifting other global markets.

Broadening markets

One caveat is that we have observed how the market grinds its way higher led by fewer and fewer names. But with the resurgence of global liquidity, 67% of individual stocks in the S&P 500 outperformed the index in the third quarter. That hasn’t happened since the first quarter of 2002. Typically, according to Bank of America, less than one-third of names do that in a given quarter. Further, 9 of the 11 S&P 500 sectors outperformed the benchmark index in the third quarter.

According to analysts, while it’s just one quarter of broad dispersion, that’s the kind of sector rotation and broadening market that make the bull market more durable.

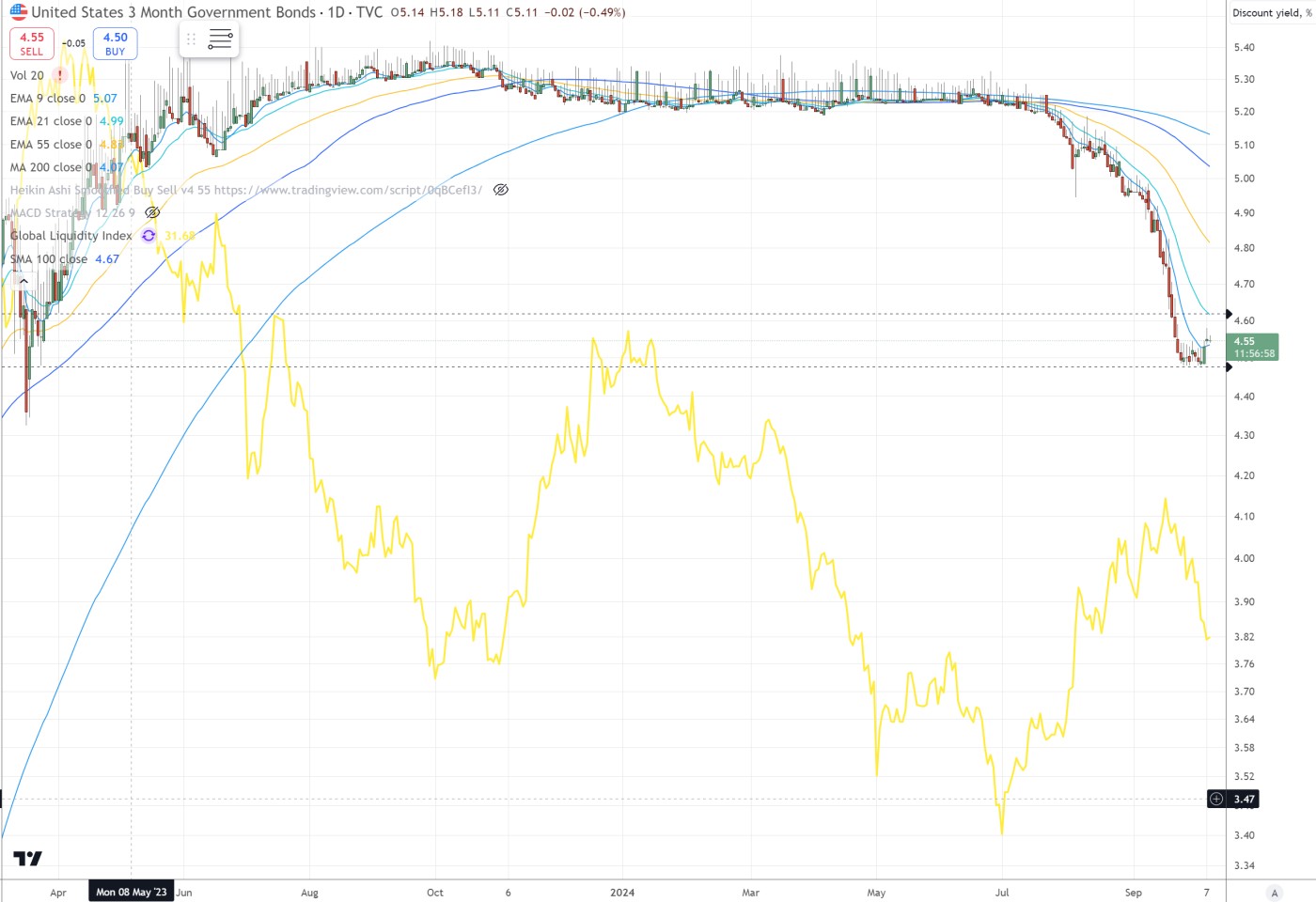

With China's bazooka blast of QE along with other central banks lowering rates, expect another wave of inflation. When this hits, it will make it difficult for the Fed to continue to lower rates by 25 bps at each meeting. CME FedWatch currently predicts 25 bps rate cuts at each of its next four meetings as it now shows two 25 bps cuts by the end of the year, though the odds of no rate cut at its next meeting is growing as implied by the yield on the U.S. 3-mo bond which is now ticking higher. The 3-mo bond predicted the Fed would lower rates by 50 bps at its prior meeting. Should its yield rise to 4.75%, that would suggest no cuts when it next meets. If Thursday's CPI comes in hot, this will push the yield on the 3-mo higher and spur the Fed to slow the pace of their rate cuts.

On the other hand, since voter fraud has been evident via Binford's numbers, is it hard to believe that critical data that guide interest rate policy such as inflation and unemployment are not also manipulated? Bank credit growth must accelerate alongside the rate cuts. So it does not matter as much how “strong” the economy is, how high the real unemployment rate goes, or how high actual inflation gets. The reported data can paint a false picture of things being better than they actually are. This suggests the Fed will continue cutting on the basis of the doctored data so the banking system can emit more dollars. The government will also continue borrowing as much as it can regardless of who wins the U.S. Presidential election. Finally, a large amount of U.S. debt refinancing is coming which is another reason for the Fed to lower rates.

Ultimately, stealth QE remains alive and well regardless of where interest rates head so expect global debt to continue its exponential rise as the interest on debt payments continues to accelerate.

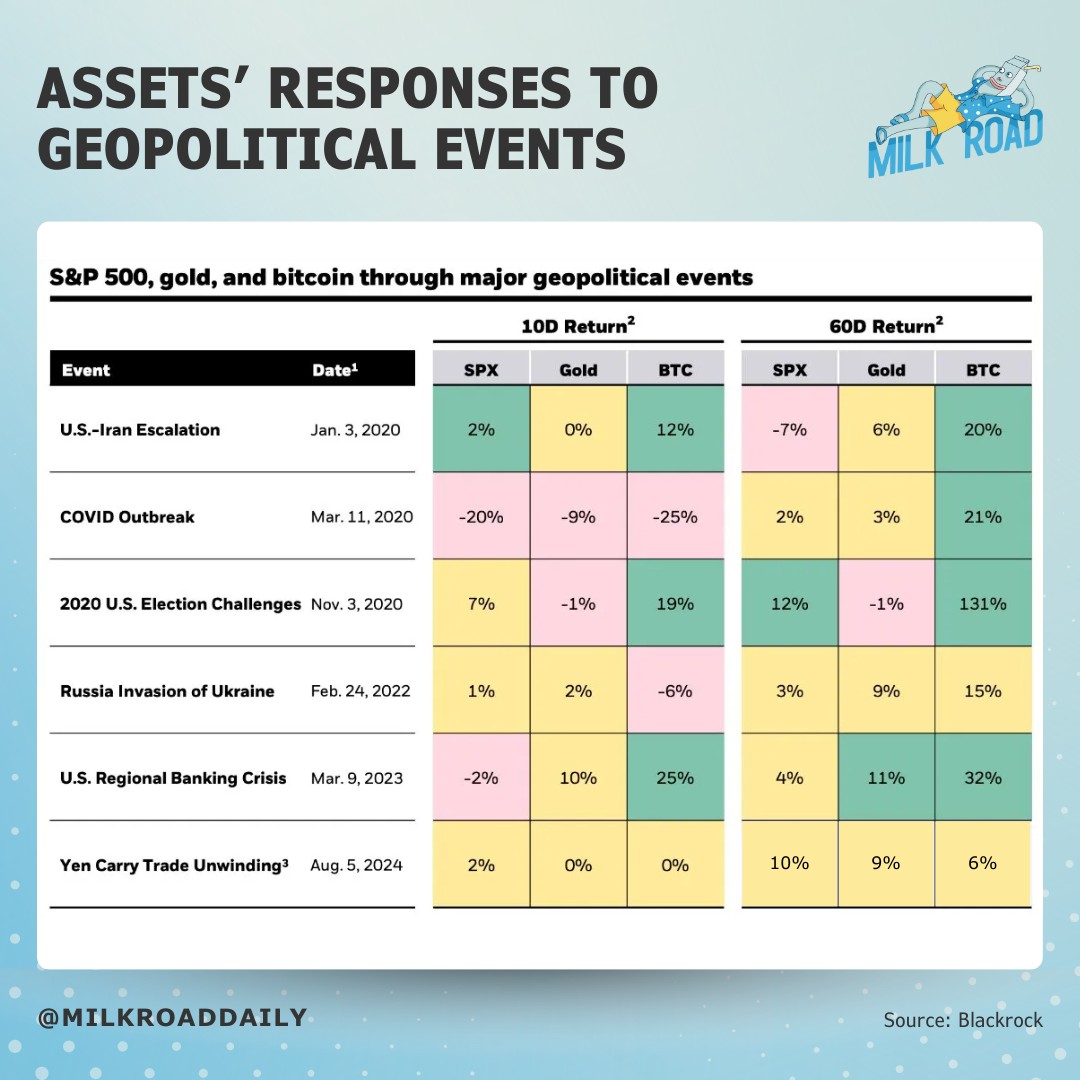

Crisis induced market dumps

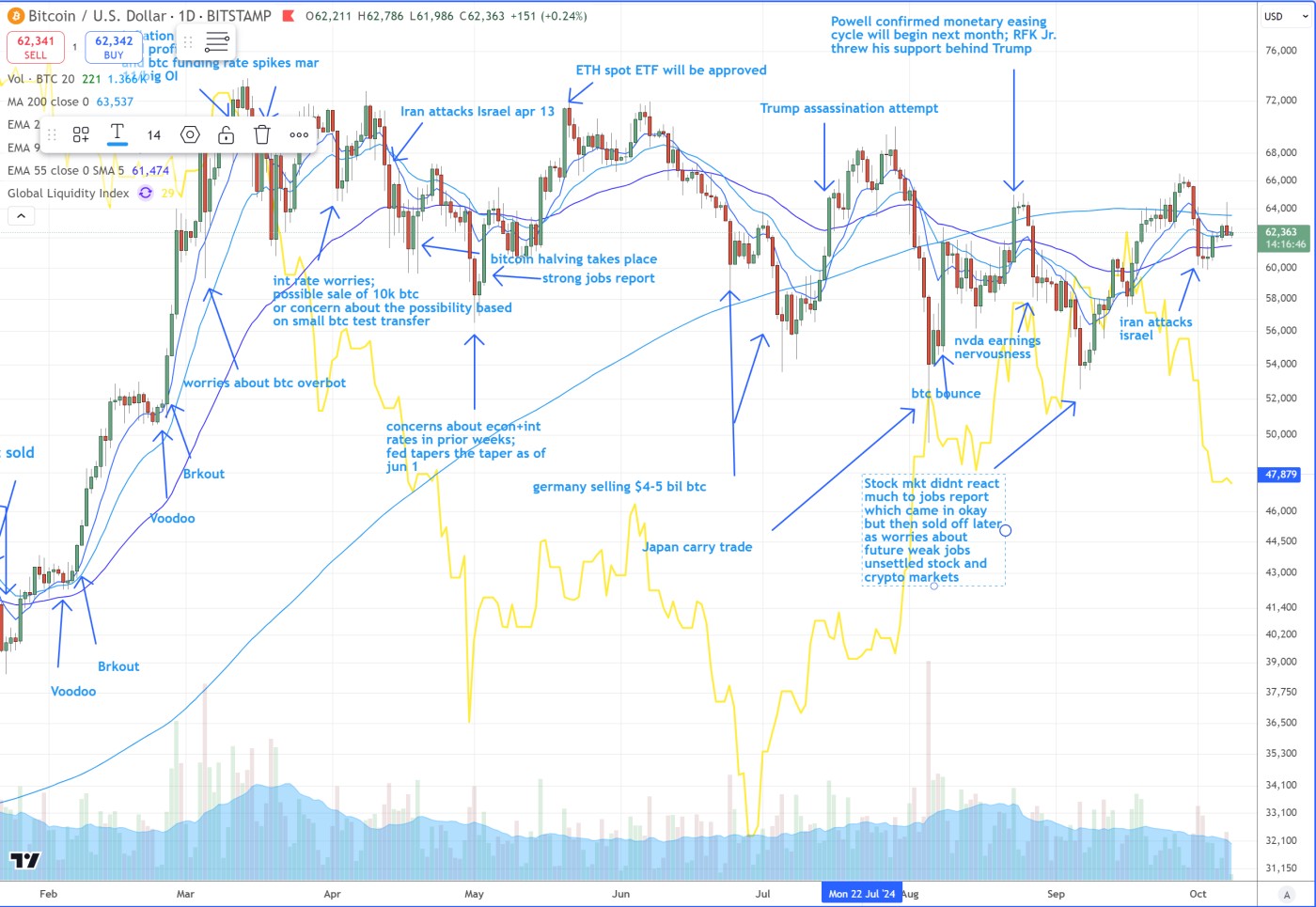

In this news driven environment, markets dump with every major crisis induced event. Five out of six times, Bitcoin has outperformed gold and the S&P 500 on a 60-day time frame, following each event. After a major event, Bitcoin’s recovery should be faster than most any other major asset if history is any guide. The only time it failed was after the recent Japanese yen carry trade disaster. This has been due to Bitcoin being more sensitive than stocks and gold to interest rate direction and acute crises. Fear prevailed in early September about future weak jobs reports. Then on October 1, Iran attacked Israel. Bitcoin has since bounced but these two issues have prevented it from resuming its price velocity.