Market Lab Report

by Dr. Chris Kacher

The Web3 Evolution Will Not Be Centralized™

Total Crypto Market Cap, which is the value of all cryptocurrencies including Bitcoin, has been channelling since March, with three higher lows and higher highs. It’s also on the verge of breaking out of a declining channel. These are all classic bullish signals, suggesting we may be coming closer to a sustainable uptrend.

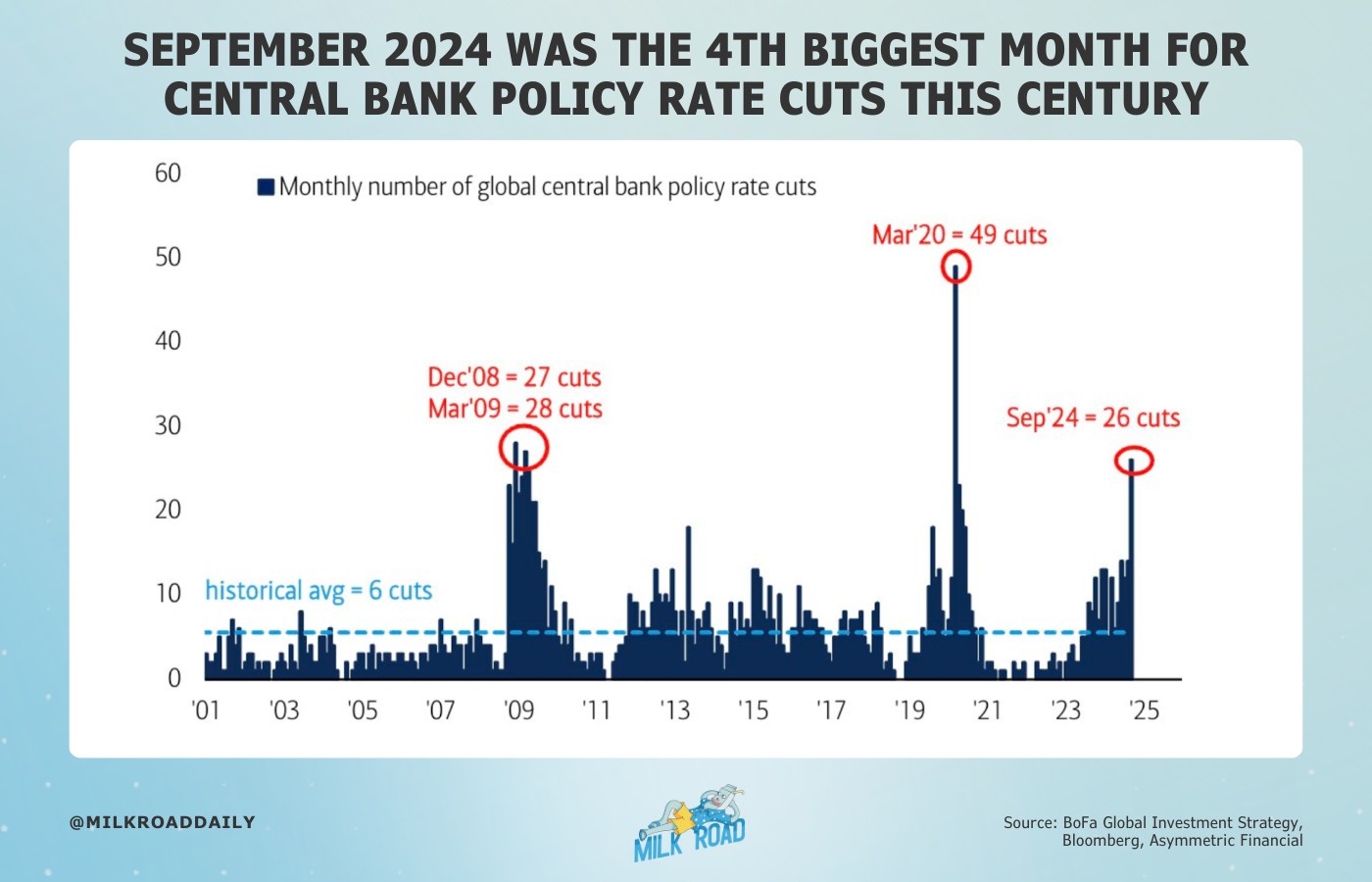

Helping the situation is global liquidity. In total, there were 26 cuts in September, making it the 4th largest month for central bank policy rate reductions this century.

Not so fast

All that said, the CME open interest on Bitcoin futures is the largest shorting open position ever (above $10B) by the large institutional leveraged funds on CME. Each time this year it has gone above 10B, Bitcoin peaks within a few days. Meanwhile, retail is calling for new highs while smarter hedge funds are shorting with 10X more shorts at the current value. This suggests that while the intermediate to longer term trend is up, the short-term trend is most likely down. Further, the stronger dollar and higher long term bond yields suggest a slowing economy and persistent inflation, both which are bearish for Bitcoin.

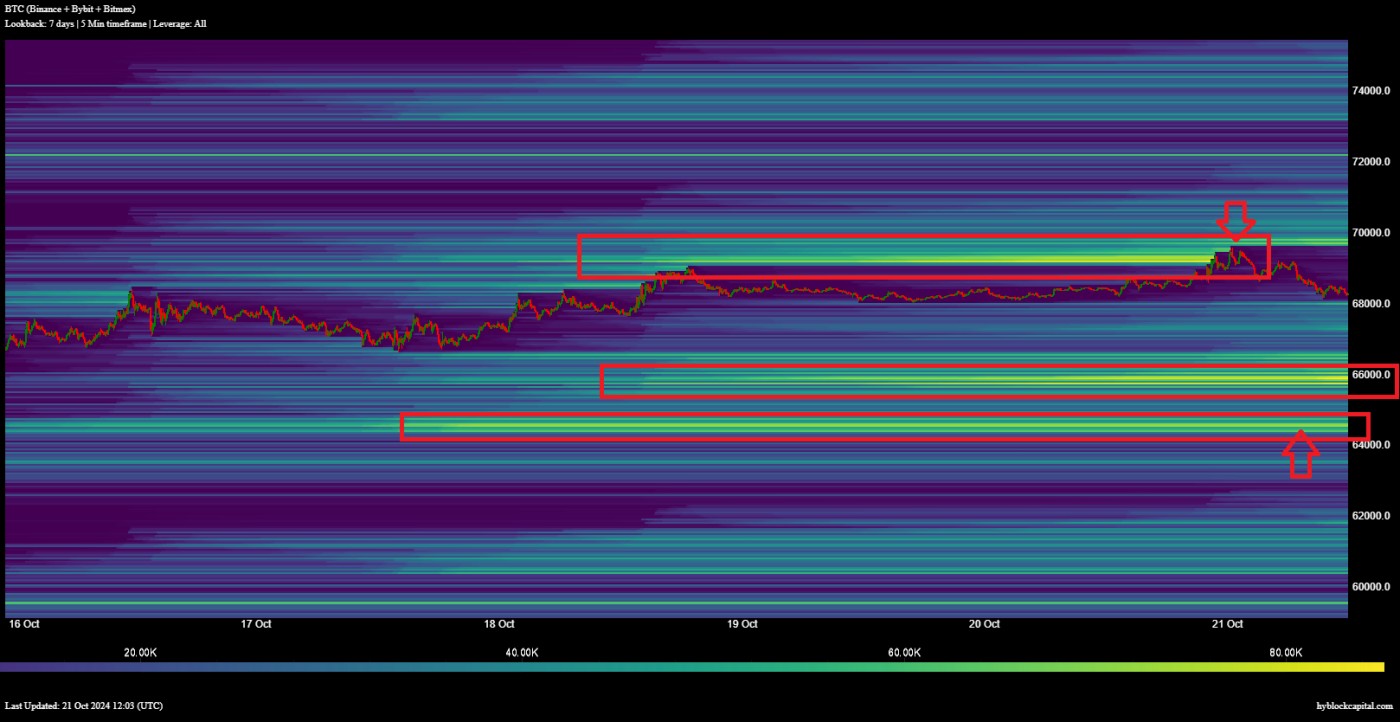

In addition, BTC grabbed buy-side liquidity during the Sunday pump. The yellow lines show the highest concentration of potential liquidations so tend to get hit. Now, most of the 7-day liquidity sits below today's price at $66k and $64,500. Combine that with open interest still at late July highs, Bitcoin near resistance, and whales starting to trim longs vs. retail, and you have the perfect recipe for a pullback. This is invalidated in the short term if BTC moves above $70k as QE is then having a greater impact than expected.

So Bitcoin is likely to make a higher low for now before trending higher over the intermediate term from stealth QE and lower rates across most central banks.

Awash in liquidity

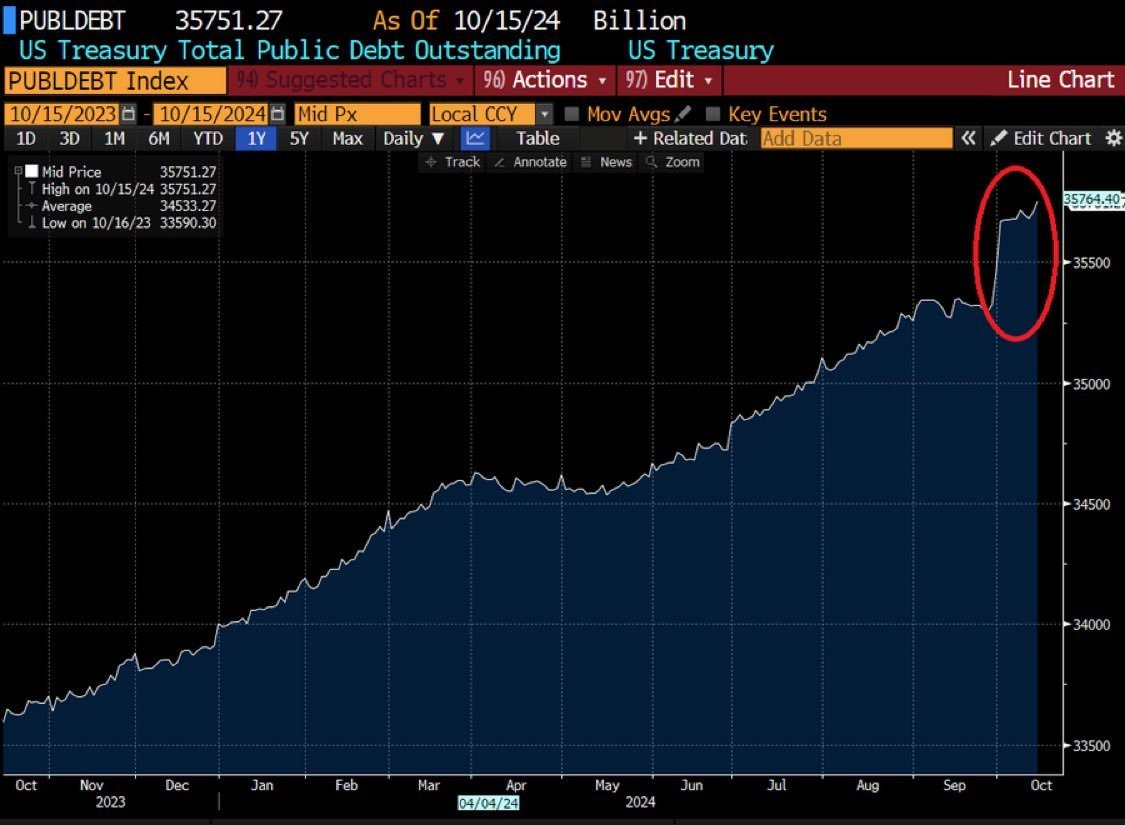

Total US debt has jumped by $473 billion over the last 3 weeks alone, to a record $35.8 trillion. This means the US has taken on $1,450 of debt for every American over these last 3 weeks. It also means that the US now holds a record $103,700 of debt for every American. In 2024, the US paid a total of $1.2 trillion of interest on this debt in its first year above the $1 trillion mark. In interest alone, the US paid $3,360 for every American during fiscal year 2024.

This is one reason why bond yields have jumped. If you drown the market with bonds created by stealth QE, the supply increases so their yields rise despite the rate cuts. In addition, investors might view the rate cuts as insufficient to address economic challenges or as a sign of desperation by central banks. If they believe rate cuts won’t successfully stimulate the economy or curb inflation, they could sell bonds, pushing yields higher. Further, bonds are a safety trade given the potential of further global geopolitical outbreaks.

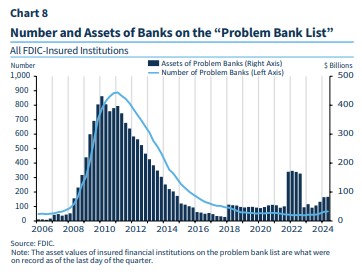

We also get bank failures due to the rising yields. Will this lead to another Silicon Valley Bank disaster? If yields get much higher, it is likely.

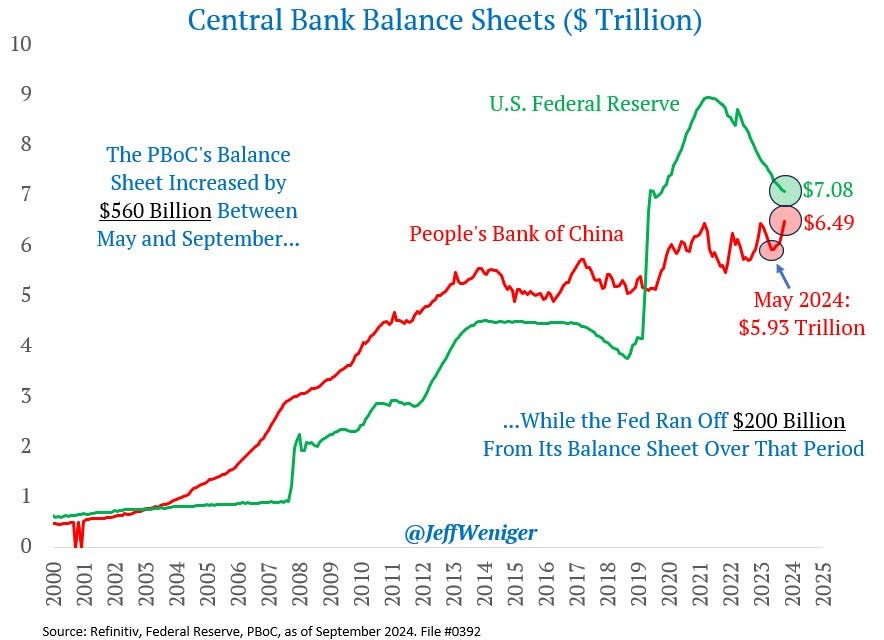

The People's Bank of China has increased its balance sheet by $560 billion in four months, a 9.4% jump, while the Fed has removed $200 billion from its balance sheet over that period. So while the Fed tightens its balance sheet, the amount of covert (stealth) and overt QE at home and abroad is a tidal wave compared to the balance sheet tightening trickle.

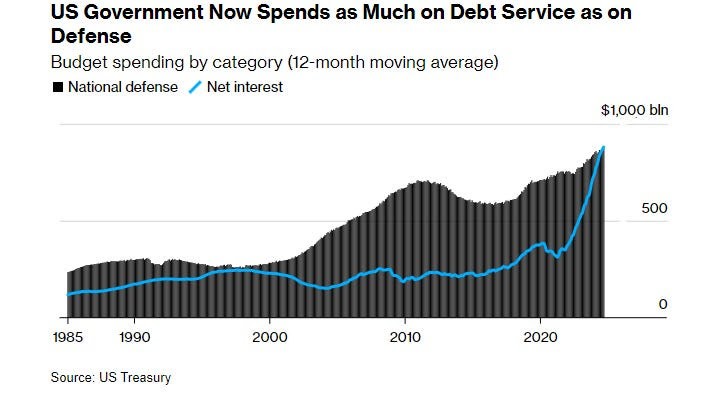

Contributing to QE is the amount the US is spending on interest payments which now exceeds the amount being paid for defense expenses.

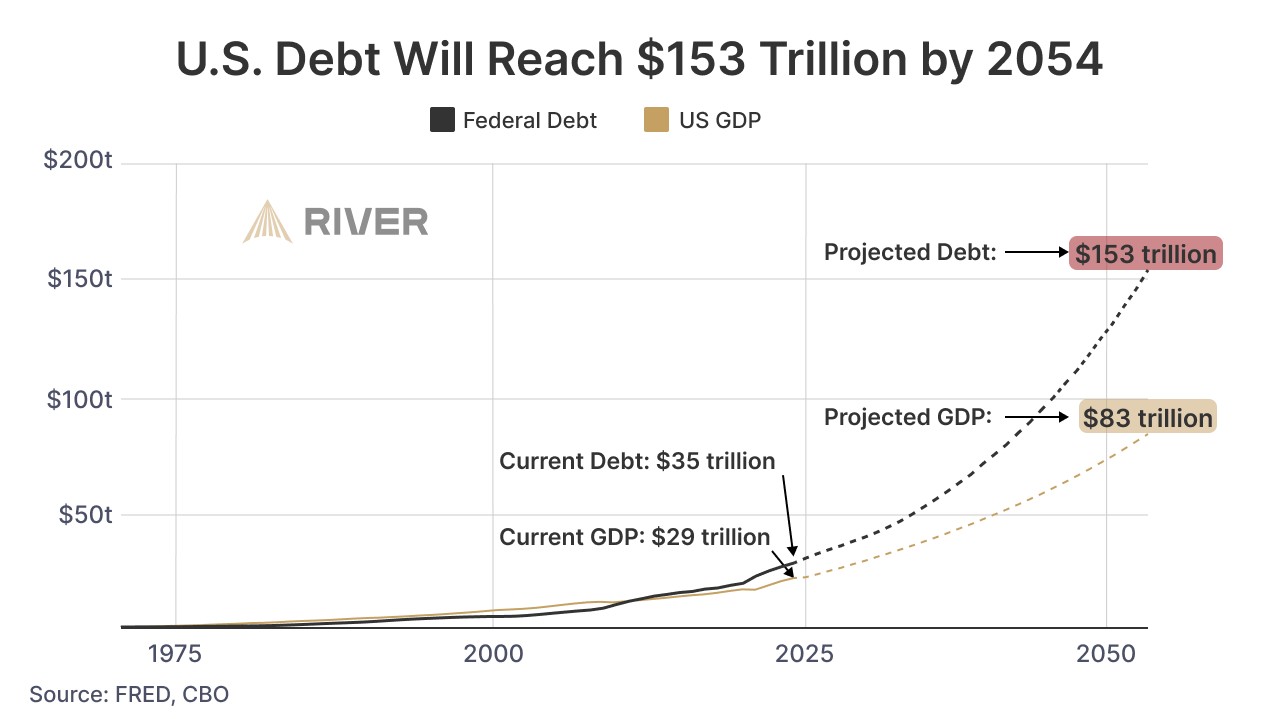

The Congressional Budget Office expects federal debt to reach $153 trillion in 30 years. Since 1970, the federal debt has grown 78x, outpacing economic growth by 300%.

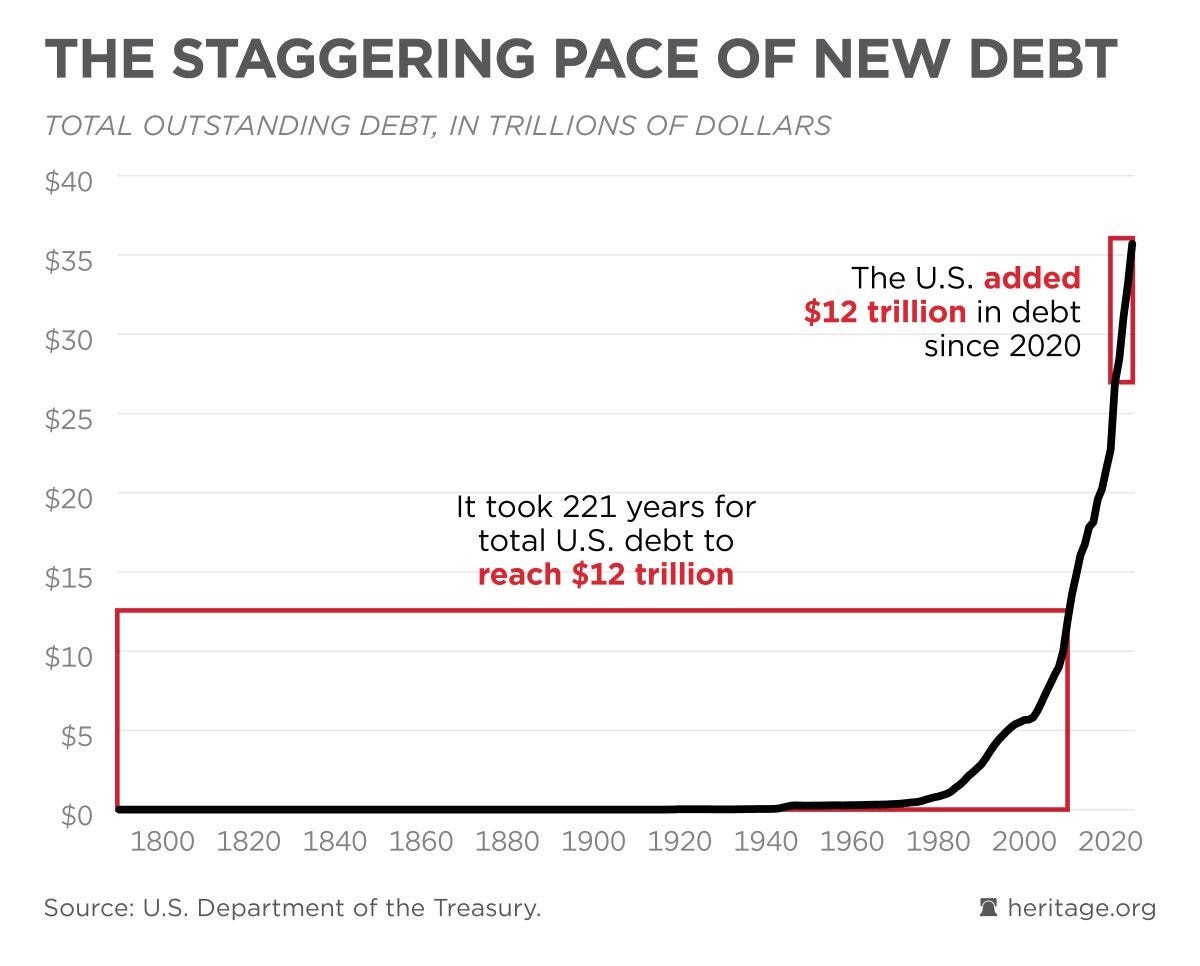

It took us 221 years for the US debt to reach the first $12 trillion. We added another $12 trillion in the last 5 years. Note how debt took off after Nixon took the dollar off the gold standard in 1971.

The national debt is growing exponentially which debases the dollar asymptotically. Inflation at 3%/year? Think again. Meanwhile, the IMF said on Tuesday that the inflation battle 'has largely been won' and that advanced economies are on target to return to 2% in 2025. Ultimately, covert and overt QE guide general market direction. QE is more important than valuations, earnings, and market sentiment.

Rising bond yields and precious metalsRising bond yields and precious metals as of late have caused alarm. Both are safety trades due to geopolitical tensions and election uncertainties come November. On the other hand, rising bond yields reflect expectations for a stronger economy — and recent retail sales, jobs, and inflation numbers all support a soft landing, at least for now. In effect, traders have pulled back on their bets for Fed rate cuts. A few weeks ago, markets saw the central bank cutting its terminal rate to around 3% by the end of 2025 but now those forecasts stand closer to 3.5%.

Election markets suggest Trump is the clear winner. Along with this, there’s a market narrative that says with Trump, you’ll have more pro-growth activities, tax cuts, and a more dovish central bank since Trump has always pushed the Fed towards easy money policies so will appoint someone more dovish to replace Powell when his term ends in May 2026. All of this will increase inflation and deficits.

What if the reverse repo facility is drained?

The reverse repo facility has been nearly drained. Many have asked where will the federal reserve get its liquidity when reverse repo facility is drained? Of course, the Fed has many tricks up its sleeve. As one of many ways, the Fed’s Standing Repo Facility allows financial institutions to borrow cash from the Fed overnight by offering Treasuries or other high-quality collateral. If the reverse repo facility is drained, the SRF could serve as a key tool for injecting liquidity into markets. Another way is the Fed’s discount window which offers short-term loans to banks and financial institutions in need of liquidity. If market conditions tighten and other sources of liquidity dry up, banks may turn to the discount window for access to cash. While it carries some stigma, the Fed could ease the terms of the window to encourage borrowing. A third and most often utilized way is the Fed can always engage in open market operations by purchasing U.S. Treasury securities and other assets from banks, increasing the money supply in the system. This would be the most direct way to inject liquidity in stealth QE fashion, as the Fed would exchange cash for assets, boosting the reserves of banks and other financial institutions.