Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The Metaversal Evolution Will Not Be Centralized™

AI game changer

The AI killer app is not something that is quite so overt. Rather, it is the story of individuals using the countless tools to enhance personal productivity. When you scale this across hundreds of millions of people, a massive impact is made.

Two tech juggernauts and some of the biggest players in the AI arms race, META and MSFT, reported strong quarterly earnings Wednesday evening. META earnings per share: $6.03, above estimates of $5.22, revenue: $40.6 billion, above estimates of $40.2 billion. MSFT earnings per share: $3.30, above estimates of $3.10, revenue: $65.6 billion, above estimates of $64.57. Yet both companies gapped lower because of concerns around the companies’ massive AI spending plans for the coming quarters.

META said it’s positioning for a “significant acceleration” in spending related to new tech and infrastructure, which will drag on profits over the next year. Meanwhile, Microsoft’s executives similarly cautioned of plenty of big AI spending ahead. “We are seeing AI drive a fundamental change in the business applications market as customers shift from legacy apps to AI first business processes,” said Microsoft's CEO.

We have an innovation wave that’s like an industrial revolution with AI.

Economic headwinds

The Chicago PMI came in weak at 46.1% vs est 46.8% which contributed to Thursday's selloff. This pushed the yields on 3-mo bonds lower as they are firmly projecting 2 rate cuts by the end of the year. Meanwhile, long bond yields continue to rise. The US has too much debt so long bonds need higher yield to attract buyers. Adding to the pressure, China been a net seller of US long bonds. This could drag the economy lower as businesses need to pay more for financing.

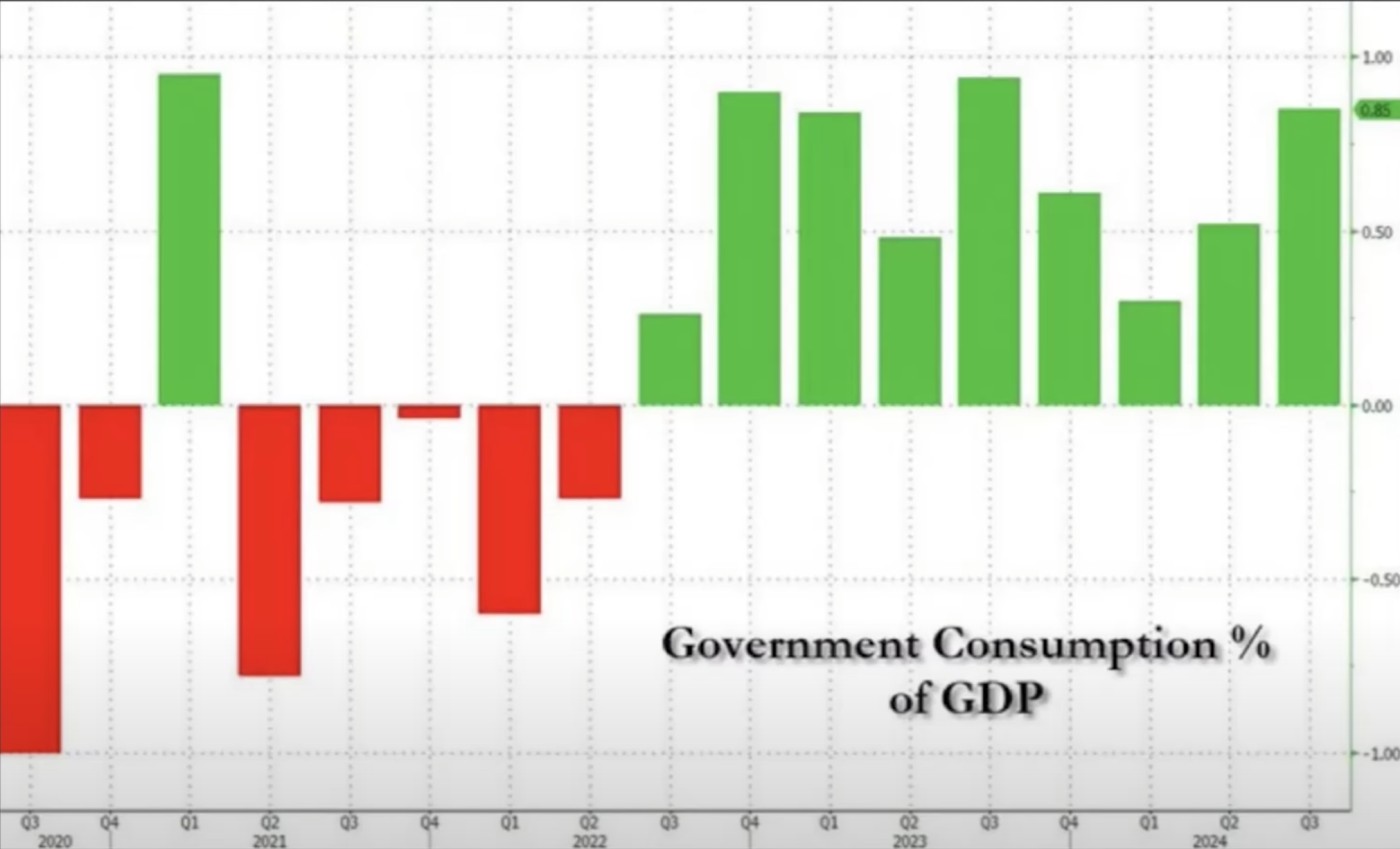

Further, the recent GDP number of 2.8% is tainted because 85% of the growth was due to government spending, not productivity. In reality, only 15% of the 2.8%, or 0.4% was the true growth ex the US government that exists in the US economy today. In fact, all of the GDP numbers have been tainted which is the reason the US was able to paper over the recession. The US also papered over real inflation. Both GDP and inflation numbers have been lies. More than 3/4 of the US working population is living paycheck-to-paycheck. Many cannot afford the soaring costs. The middle class has therefore been deeply compromised, a number of them being pushed into the lower class, while some lower class has been pushed into homelessness.

The prime rate just hit 8%. This will have an impact on those who want to take out loans for businesses, homes, cars, and computers. This all looks recessionary but the official numbers are deeply biased. We cant even begin to talk about the real numbers because the government distorts the numbers. Capital markets will eventually malfunction. The only way out is to clean up the balance sheet, net of QE.

But if we examine hundreds of years of cycles as detailed by Ray Dalio, this has never happened because politicians want to make empty promises to the people while central banks print their currencies into oblivion. Deep cuts in spending is required, creating a smaller government. But this is politically difficult to do because special interests fight like hell along with representatives in Congress to represent their constituents. So with record debt, this shell game may be coming to an end. This is why sovereign fiat currency has a limited lifespan. War and revolution have always created a new start with a new sovereign currency.

In the coming years, the US dollar could have a real problem with the creditworthiness of the US challenged. But the US remains the tallest standing midget as still the world's strongest economy. That said, BRICS had greater GDP in the aggregate than the US so they could challenge the US sometime over the next decade.

Banking crisis revisited

Many banks are sitting on unrealized losses due to loans that go bad as rates go up. Because long bond yields have risen, bad loans are now in the trillions, greater than what we saw during the financial crisis of 2008. As one example, this is the reason why Warren Buffet sold his Bank of America stock. While some fear a major credit crisis, if such were to occur, the Fed would just print their way out of the mess as they did in March 2023 to rescue banks such as Silicon Valley Bank.

But we also have many homeowners who will need to refinance their rates from the typically 3-4% they got a few years ago before the Fed raised rates faster than ever in history to where the prime rate now sits at 8%. This effectively doubles their monthly payments. Many may not be able to afford the huge increase thus creating a wave of loan defaults. Banks dont have to mark their positions to market which is what caused the massive bank failures in March 2023. The banks hope long bond yields will drop as interest rates fall. But higher deficits typically help push long-term Treasury yields higher because the increased supply of bond debt needed to finance the deficit pushes yields upward.

As these loan costs climb, the higher rate increases the annual expense which means you have to issue more debt to pay the interest on the current debt. When debt-to-GDP gets to a certain level, the problem compounds. This has been the beginning of the cataclysmic collapse of every great empire when they cant arithmetically get out of their debt spiral.

Inflation starts to accelerate as central banks monetize their debt by printing more fiat, underscoring fears that the world may get Zimbabwe'd in the coming years. Indeed, fiat trending toward zero seems inevitable unless cutting edge technologies such as AI can generate sufficient real wealth that the global debt burden is materially reduced. The problem is most world leaders have no choice but to print to keep their economies above water which has pushed debt interest dangerously close to becoming a black hole once we cross that financial event horizon.

Long bond yields soar on Trump win

But the Trump victory can pull us back from the brink since higher growth is expected as witnessed by soaring yields in long bonds due to increased demand for risk on assets such as stocks thus away from bonds which consequently drive yields higher. Also a factor in higher yields is the potentially expansive fiscal regime which could lead to increased borrowing, economic growth, and therefore inflation. Plus AI being fiercely game changing for most from individuals to companies to governments.

Republican majorities in Congress are pro-growth. It currently looks as if republicans will likely hold the majority in the Senate so the only issue is the House of Representatives where republicans have a narrow lead with 220 seats vs 212 for Democrats, with 3 vacancies. Prediction markets on Kalshi give Republicans an 85% chance for the Senate and 52% for the House.

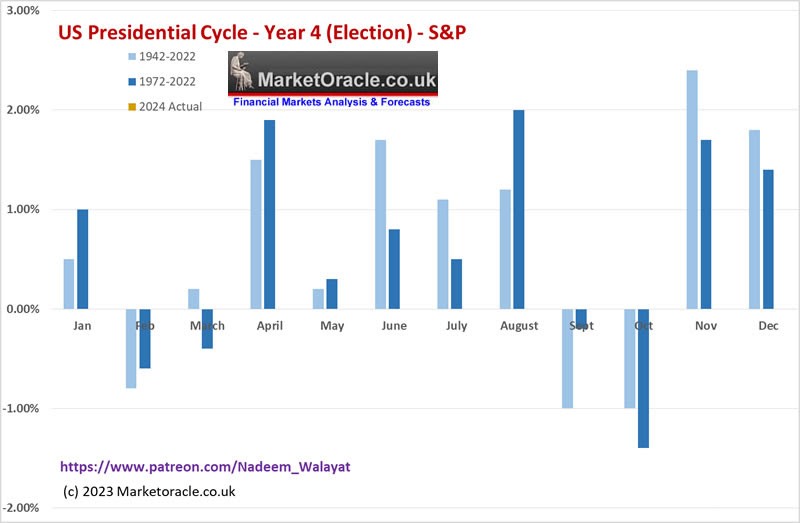

Presidential election's impact

As discussed in our Focus List Review, US presidential elections are bullish for markets. In both 2016 and 2020, markets rallied after the votes were tallied, even in 2020 when the Trump camp contested the results. Both times had QE in force. Currently, stealth QE, lower rates with markets predicting two more rate cuts this year, and rising global liquidity all reverse the tightening trend of 2022 which should favor higher markets. You can see that both Nov and Dec were bullish months for markets.