The recent drop was caused by several factors, starting with weak earnings from Google on July 24, followed by Microsoft's disappointing results on July 30. Despite these setbacks, overall earnings so far have been better than expected, as seen in previous quarters. Additionally, a disappointing jobs report caused another market gap down on Friday. Preliminary reports indicated that the unemployment rate increased by 0.2%, partly due to temporary layoffs from Hurricane Beryl, which significantly affected payroll gains. The number of people out of work due to bad weather reached 461,000, the highest for July on record. The BLS downplayed this, but the New York Times noted that nearly half a million people reported being employed but not working due to bad weather, the highest since January.

Nevertheless, the odds for a half-point cut in September are jumping.

In early 2018, when the economy was slowing, major averages experienced sharp pullbacks like we are seeing now, but eventually reached new highs despite shrinking QE. To minimize such whipsaws, the model made an adjustment in 2019 to hold positions longer to minimize whipsaws while profiting from a larger portion of an uptrend in this Era of QE.

Sharper pullbacks have been rare. In each case, the model was typically either in cash or on a sell signal such as in 2020 where it had huge gains from the COVID crash and in 2022 during most of the bear market. These deeper selloffs have been a result of: 1) late 2018 due to balance sheet tightening, 2) early 2020 due to COVID-19 (mitigated by QE), and 3) 2022 due to rate hikes (reduced QE). Since QE began in late 2008, traditional recessions have been avoided or postponed by the Fed's interventions.

Today, major central banks are injecting QE into the system to address slowing economies. This should help prop markets as macro tends to guide major averages but that does not mean markets cant fall further. Expect a continuation of heightened volatility.

Note below how the NASDAQ-100 fell in 2022 and from July to October 2023 both times as a result of falling global liquidity (QE, GMI). That said, in 2024, major averages continued to new highs despite the fall in global liquidity due in part to strong earnings, falling inflation, and utility created by big tech companies. "Stealth" QE was also a big factor in propping markets since governments must print to pay for onerous debt interest and unfunded liabilities among other expenses.

The Fed will add to the liquidity pool or may even justify renewed QE to prevent a traditional bear market based on their prior behavior. This is not to be confused with stealth QE, or what some call the shadow monetary base, which is ongoing. They certainly now have room to lower rates.

At the start of prior rate reductions, markets often did not enter recession for some months if we look at the fed funds rate. In 2007, the Fed started lowering rates in August but the stock market did not top until November. Recession then started in December. In 2001, rate cuts started in March but the market had already topped in March of 2000. There have been no standard recessions since QE was launched in 2008.

It was only recently that major averages were facing overbought conditions such as the S&P 500 hitting new highs on July 16. But disappointing earnings news out of majors such as GOOGL and MSFT together with a weak jobs report have pushed markets down hard. Exacerbating the selling has been the margin call induced forced selling. This often creates "V" bottoms in major averages along with a spiking VIX and put/call ratio, but that does not mean the market cant go lower in the interim. Expect a continuation of heightened volatility in both directions.

As a consequence of the slowing global economy, global liquidity is on a recent sharp rise especially when accounting for private sector liquidity which includes all flows of cash and credit as well as major central banks as shown in the chart below. Chinese QE starting in late 2022 was the major catalyst as to why markets rallied sharply in early 2023.

One factor contributing to the recent sharp rise in QE/GMI is the yen carry trade which is in the trillions. The yen carry trade is also contributing to the selling of US equities. The Japanese government is telling Japanese banks who hold USTs to sell them to buy Japanese bonds to keep interest rates at bay or the interest on their massive levels of debt will jump. At the same time, the US needs to prevent interest rates from rising. This is forcing the US Fed to print to honor Japanese banks who are holding massive amounts of USTs because the US cannot afford to have Japanese banks selling USTs which would send yields higher. I mentioned the following in a prior report:

While global liquidity as a measure of total QE has been in a downtrend, Arthur Hayes has mentioned another boost in stealth QE will come from preventing Japanese banks from selling their US Treasury bonds due to steep losses on their books from rates having risen at the fastest pace in history. Using the FIMA repo facility which was created by the Fed, Japanese banks will raise cash via stealth QE courtesy of the US Fed without having to sell their US Treasuries. The Fed will not allow that to happen since yields would then rise given the amount of selling Japanese banks would have to do. So the Fed used its repo facility created back in 2020. As the Fed stated:

In March 2020, during the “dash for cash,” central banks simultaneously sold US Treasuries

and parked the proceeds in overnight repos at the New York Fed. In response, the Fed at the

end of March offered to agree to provide overnight advances to central banks using US

Treasuries held in custody at the New York Fed as collateral at a rate above private repo rates.

Such advances would allow central banks to raise cash without forcing outright sales in an

already strained Treasury market.

This will result in a big wave of stealth-QE from the Fed above and beyond the $2 trillion already being spent this year.If we take a bird's eye view using a monthly chart of the S&P 500, QE/GMI liquidity drives markets:

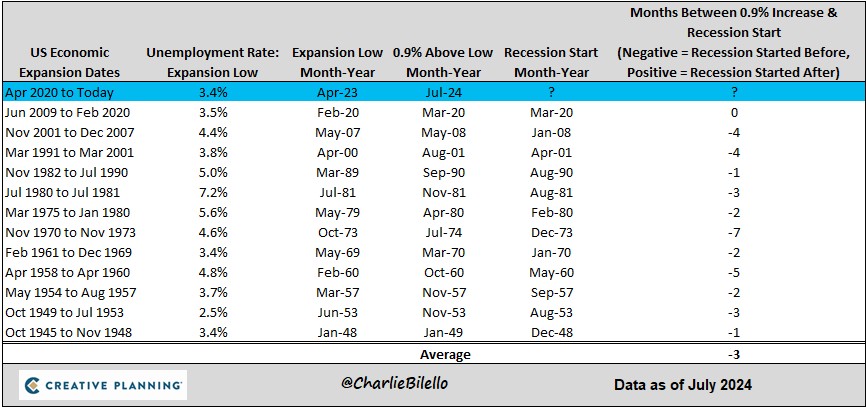

History suggests recession may have already started based on the table below. It will be worthwhile to see if the Fed finds a reason for renewed QE (in addition to the ongoing "stealth" QE) as they did in Mar-20 which led to the shortest recession on record of one month and prevented one in Mar-2023 when we had one of the largest banking disasters.