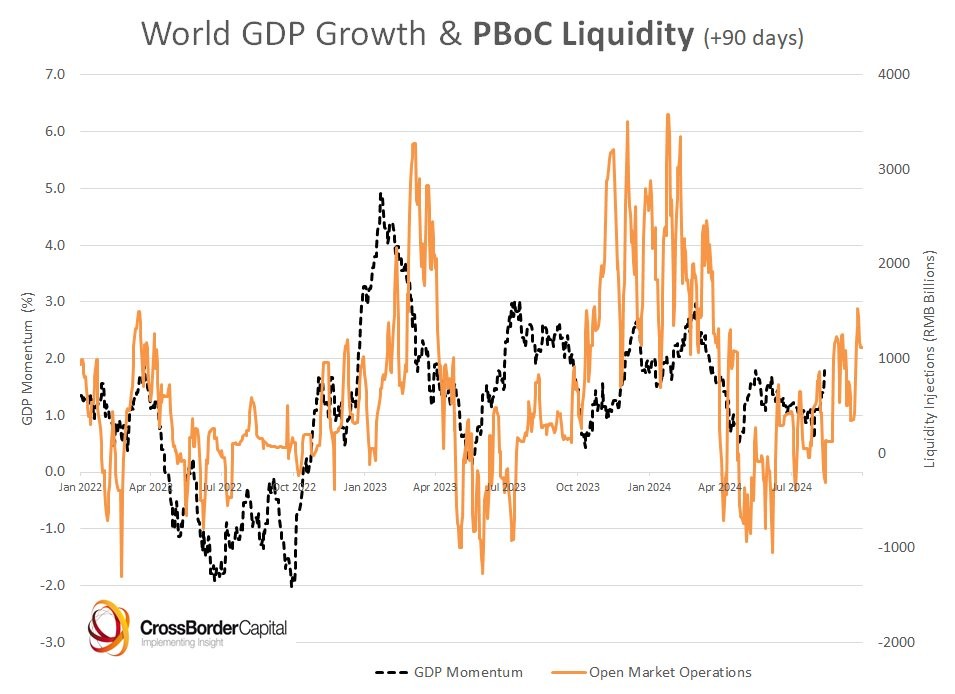

The recent BLS revision of 818,000 fewer jobs than previously reported over the 12 months ended March means job growth was 1.4% in March 2024 vs. the previously reported 1.9%. This is the largest revision since 2009. The US has likely been in a recession for a number of quarters were it not for the distorted official figures of unemployment, GDP, CPI, PPI, and PCE. Certainly most of the world has not been economically healthy though a bounce from money printing can be observed in some countries as GDP growth ticks higher. China's QE in late 2022 followed by other central banks in early 2023 contributed to the growth in GDP during that time.

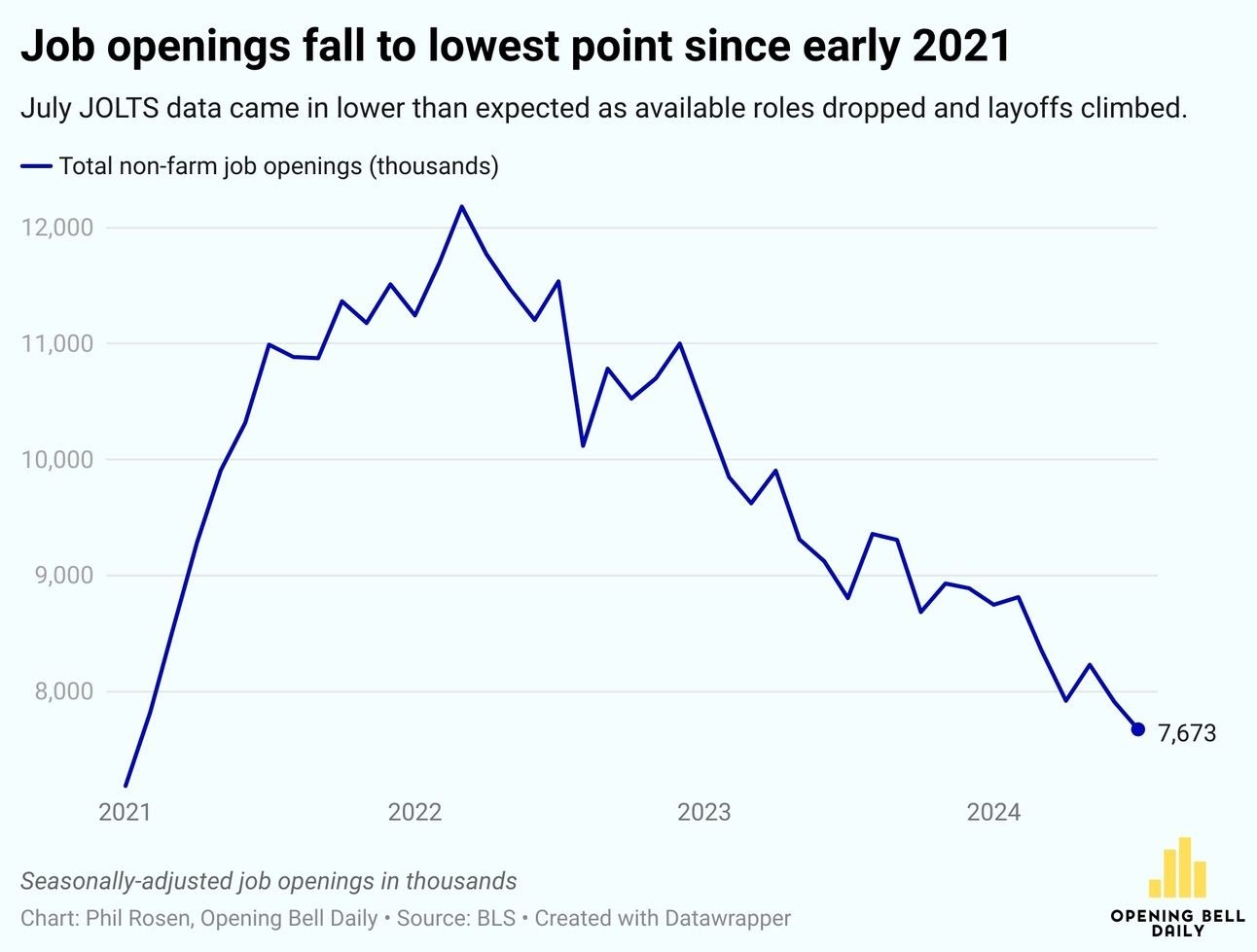

Another nail in the coffin was today's JOLTS survey showed total job openings in July fell to the lowest level since the start of 2021. Layoffs, meanwhile, climbed to 1.76 million, the most since March of last year.

The ratio of empty jobs per unemployed worker fell to 1.1 in July, the lowest since 2021 and well below the 2-to-1 ratio seen in 2022. The report underscored recent concerns from the Fed that the jobs market is getting weaker and labor demand is softening. “As Chairman Jerome Powell said recently, further cooling of the job market is unwelcome,” said Bankrate senior economic analyst Mark Hamrick. “But that is exactly what the JOLTS update conveys.”

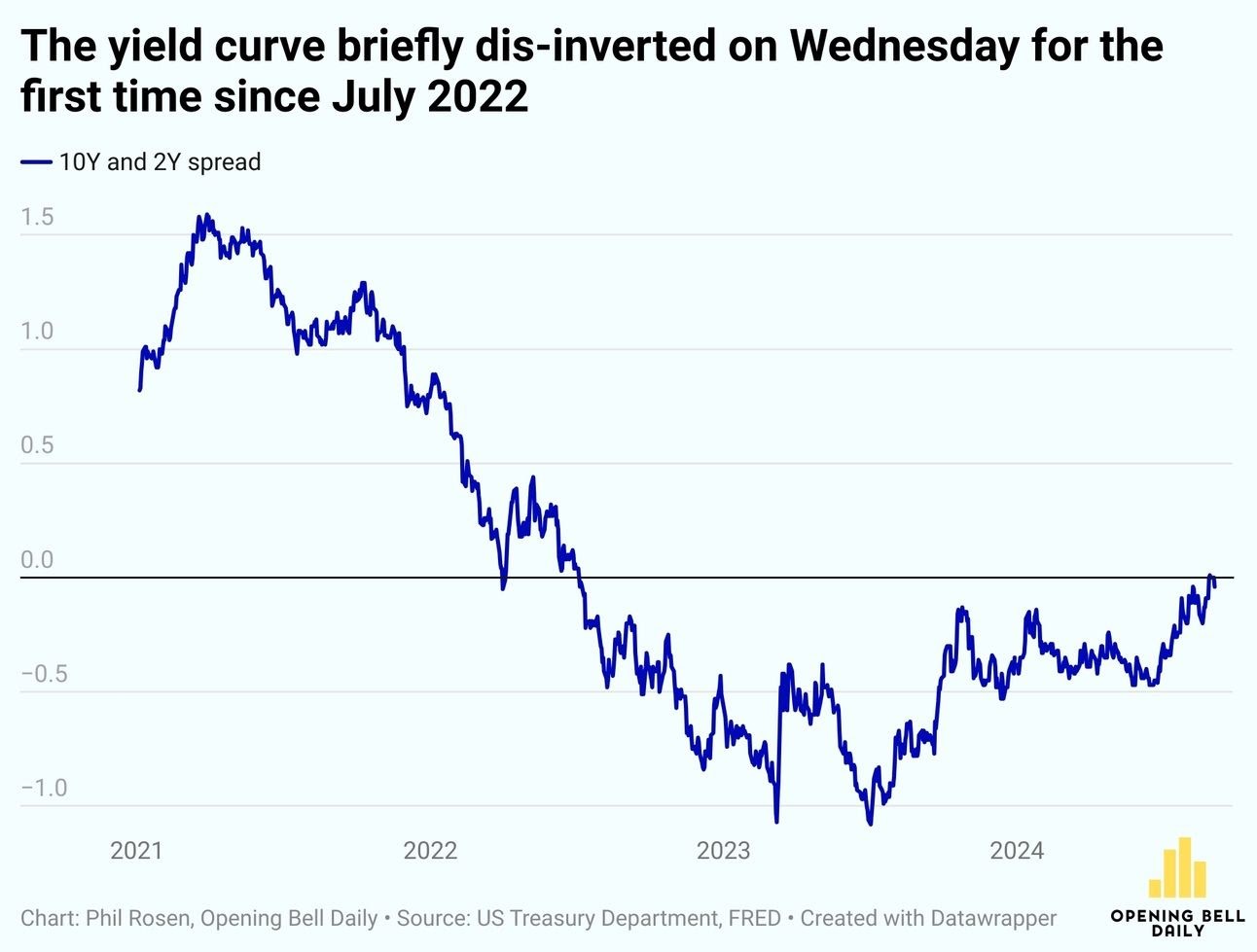

Treasury yields fell, with that on the two-year note dipping below the 10-year yield for just the second time since 2022.

Just after the JOLTS survey, the odds of a 50 bps rate now stand at 45% when the Fed meets later this month. The yield curve has been inverted for a historic 27 months without a meaningful economic slowdown. When it uninverts, the S&P 500 has underperformed out to at least a few months. But that data is based on pre-2008 before the Fed and other central banks could simply sandblast markets with QE though there will likely be lag time so, in the meantime, markets could fall further. In addition, price/volume action in major indices and leading stocks has shown sufficient selling pressure since the bounce.

And today's ADP employment report was the weakest since Jan-2021 coming in at 99k vs 145k est, though unit labor costs came in at 0.4% below 0.8% est and nonfarm productivity matched expectations at 2.5%.

This Friday's jobs report will be key though keep in mind much of the data is distorted. Markets dont seem to pay much attention to this fact, but instead focus on the data as it is reported.

That said, QE in all its forms is alive and well and is accelerating so the model may flip back to buy depending on how price/volume action unfolds.

List of Potential ETFs for investors:

1-times inverse

PSQ - NASDAQ 100 1x bear.

2-times inverse

QID - NASDAQ 100 2x bear.

3-times inverse

SQQQ - NASDAQ 100 3x bear.

NOTE: This is a suggested list. Investors may wish to become acquainted with the full range of available ETFs, and should make an effort to understand how these ETFs are created and what their components are, as well as being aware of the downside risks involved, especially with leveraged ETFs. Certain ETFs may be more appropriate depending on one's risk tolerance levels. Typing in keyword 'ETF' into the FAQ keyword search bar or going here https://www.virtueofselfishinvesting.com/faqs/search?p=1&q=etf and visiting this site https://etfdb.com/ can be instructive.