For the last several years (since Feb 9, 2019), MDM has allowed for greater selloffs to minimize whipsaws. The risk is larger losses but since then, it has worked well overall. https://www.virtueofselfishinvesting.com/faqs/answer/while-the-model-has-done-well-since-early-2019-and-outperformed-from-early-2016-to-early-2018-it-had-difficulty-for-much-of-2018-please-explain

NASDAQ Composite ($COMPQ) and S&P 500 ($SPX) had been trading in a sideways, choppy band since December 2024. $COMPQ reached the lower end of its band on Tuesday then broke below while the $SPX is still within its band. MDM has had 5 distribution days over the last 20 days with the fifth being on Thursday which puts it on a sell signal standby. But this coincides with $COMPQ at its 200dma:

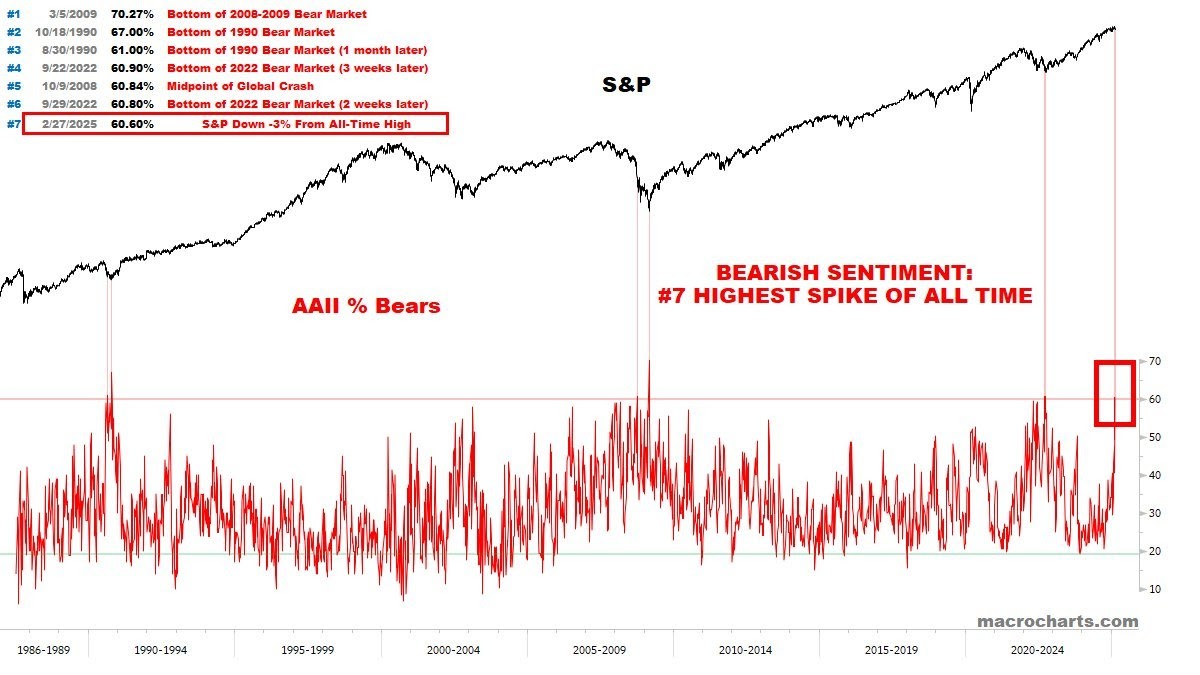

Also, AAII sentiment is at levels seen near or at major market lows.

Meanwhile, global liquidity / stealth QE continues to pump and should reaccelerate sooner than later based on various metrics. https://www.virtueofselfishinvesting.com/reports/view/market-lab-report-ism-vs-global-liquidity-vs-markets

Nevertheless, $COMPQ is below its 200dma so MDM will move to cash.

MDM will watch for a resumption of the uptrend in the coming days should it occur.