Model switches to CASH/NEUTRAL.

The DJIA and broader based NYSE Composite have been badly lagging the more tech-centric NASDAQ Composite and NASDAQ-100. The bifurcation of stocks is at an extreme with more and more stocks lagging than before. We also have the NVDA 10:1 split which may create a major top for NVDA which would upset major averages.

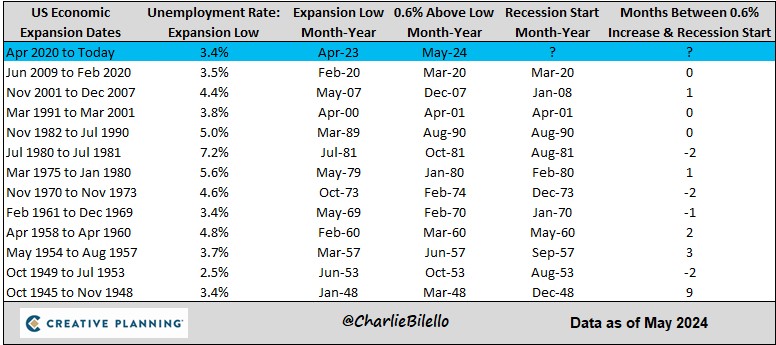

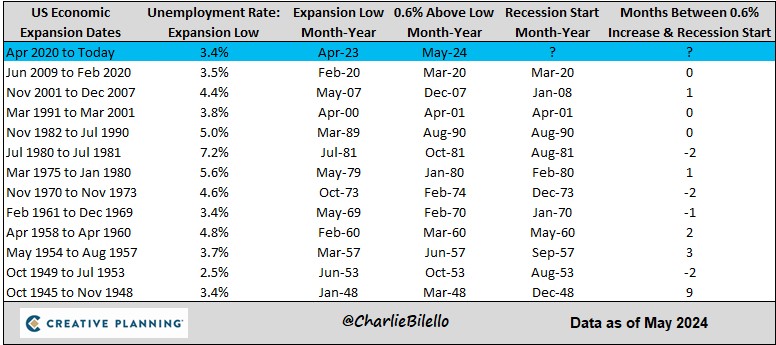

The jobs report came in hot showing wage inflation pressures. The Fed is therefore less likely to lower rates sooner than later. The unemployment rate is now 0.6% above the cycle low from April 2023 (3.4%). Historically, that 0.6% move higher has occurred near the start of a recession. But this time, stealth QE is prodigious and continuous thus may continue to prop markets. It will be key to keep a close eye on future unemployment rates to see if they can hold steady. In prior times, unemployment starts to quickly rise.

The EU lowered rates for the first time since 2019. It is surprising they are doing this ahead of the US Federal Reserve which may mean recession is incoming in the EU.

This information is provided by MoKa Investors, LLC DBA Virtue of Selfish Investing (VoSI) is issued solely for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. Information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of available data. VoSI reports are intended to alert VoSI members to technical developments in certain securities that may or may not be actionable, only, and are not intended as recommendations. Past performance is not a guarantee, nor is it necessarily indicative, of future results. Opinions expressed herein are statements of our judgment as of the publication date and are subject to change without notice. Entities including but not limited to VoSI, its members, officers, directors, employees, customers, agents, and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. Additional information is available upon written request. This publication is for clients of Virtue of Selfish Investing. Reproduction without written permission is strictly prohibited and will be prosecuted to the full extent of the law. ©2025 MoKa Investors, LLC DBA Virtue of Selfish Investing. All rights reserved.