MDM has switched to a BUY signal.

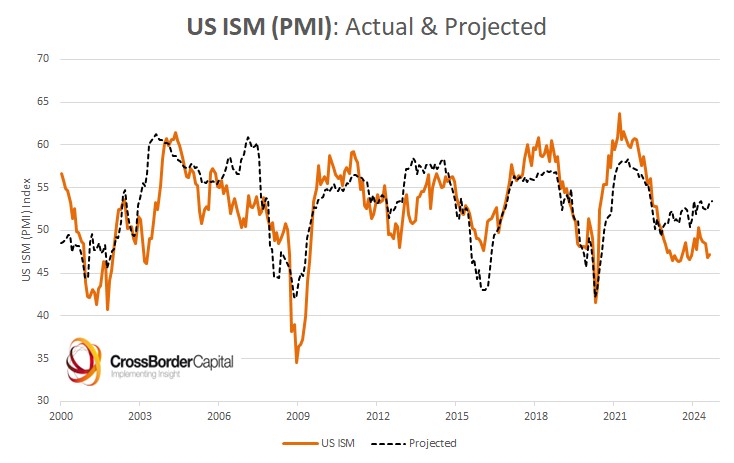

The Bank of Japan ensured they would not be raising rates. CPI came in relatively as predicted though a little hot on core MoM CPI 0.3% vs est 0.2%. Nevertheless, premarket futures rallied.The US credit markets (broken line) see the economy as measured by the headline ISM Index not heading into recession. Credits lead the economy by a few months and statistically show strong causality as noted by Raoul Pal et al. ISM is cyclical so its lows were likely already reached, especially given accelerating global liquidity and lower rates ahead.

That said, should upcoming doctored data suggest an economy that is slowing too quickly forcing the Fed to cut by 50 bps, that would be bearish for markets.

Suggested ETFs (Note: Many members buy the standard ETFs or their preferred ETFs. This list serves as a guide as to which ETFs we think may outperform, but the key point is to be on the right side of the market regardless of which ETF or ETFs one chooses.)

1-times

SPY (S&P 500)

QQQ (NASDAQ-100)

2-times

SSO (S&P 500)

QLD (NASDAQ-100)

3-times

UPRO (S&P 500)

TQQQ (NASDAQ-100)

TECL (Direxion Trust Technology)

NOTE: This is a suggested list. Investors may wish to become acquainted with the full range of available ETFs, and should make an effort to understand how these ETFs are created and what their components are, as well as being aware of the downside risks involved, especially with leveraged ETFs. Certain ETFs may be more appropriate depending on one's risk tolerance levels. Typing in keyword 'ETF' into the FAQ keyword search bar or going here https://www.virtueofselfishinvesting.com/faqs/search?p=1&q=etf and visiting this site https://etfdb.com/ can be instructive.