Dr. K's Crypto-Corner

by Dr. Chris Kacher

Cryptotechnologies... Kryptonite for Governments™

Acceleration

The trade war accelerates then decelerates then accelerates again, much like a stock in a downtrend that backs and fills before going lower. On Thursday, a spokesman for China’s commerce ministry said China would not immediately respond to the latest tariffs imposed on them which sent U.S. markets higher.

Ministry of Commerce spokesman Gao Feng said at a press conference that “the question that should be discussed now is about removing the new tariffs to prevent escalation.” Last week, Beijing imposed new tariffs on $75 billion of U.S. goods which prompted a retaliation by the U.S. which imposed an additional 5% levy on Chinese goods. “Escalation of the trade war won’t benefit China, nor the U.S., nor the world,” Gao was quoted as saying. Nevertheless, Trump is going to play a hard game here as he knows he can force the Fed to lower rates, making any agreement between the two nations less likely, at least for a number of months.

Indeed, on Sunday, China and the United States began imposing additional tariffs on each other's goods, the latest escalation in a bruising trade war. Since Thursday's calming words out of China, it certainly did not take long to reverse what was said and instead escalate. Trump on Twitter wrote his goal was to reduce U.S. reliance on China and again urged American companies to find alternate suppliers outside China. A new round of tariffs took effect from 0401 GMT, with Beijing's levy of 5% on U.S. crude marking the first time the fuel has been targeted since the world's two largest economies started their trade war more than a year ago. Meanwhile, the Trump administration began collecting 15% tariffs on more than $125 billion in Chinese imports, including smart speakers, Bluetooth headphones and many types of footwear.

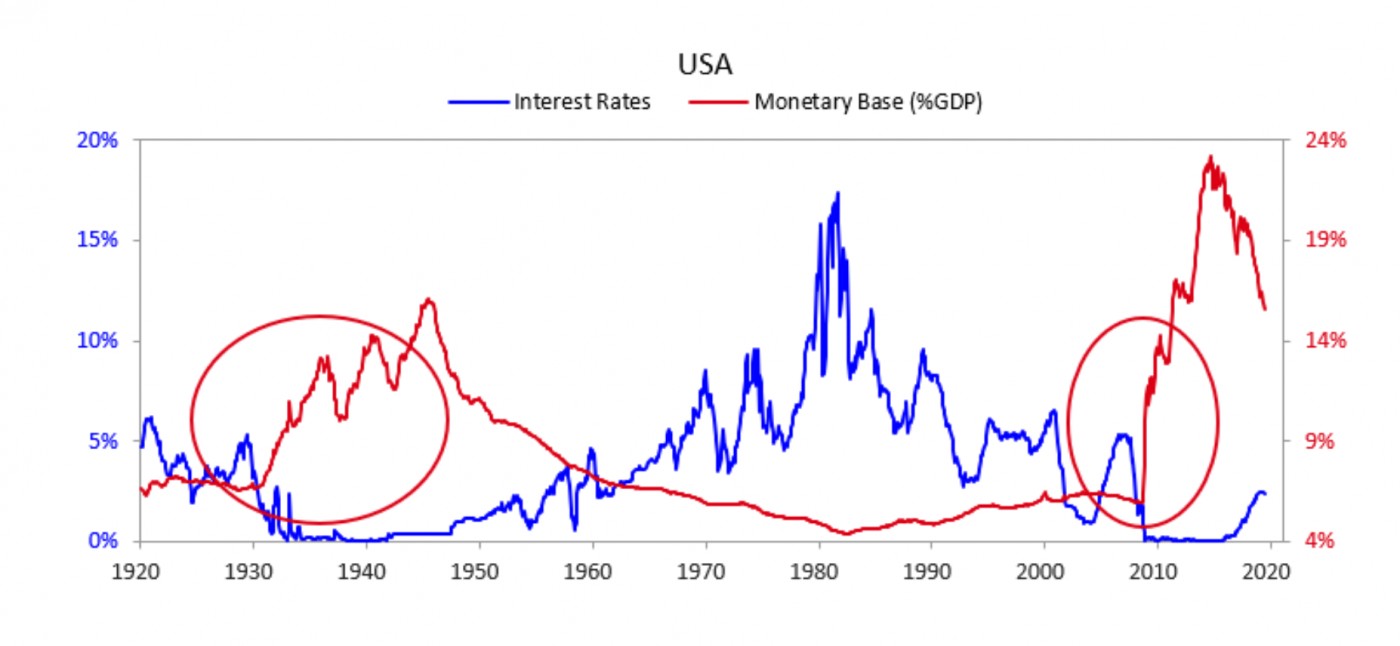

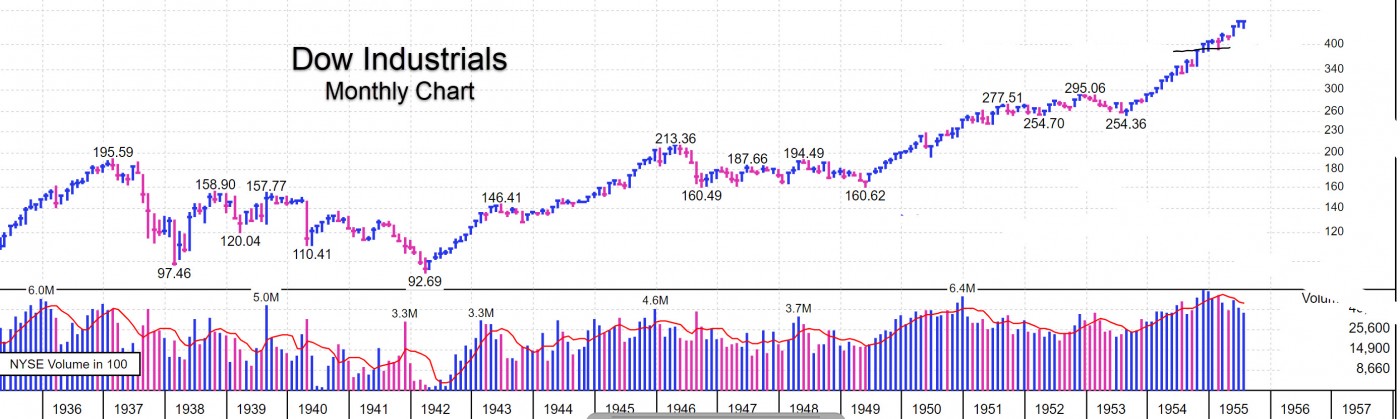

Whether the debt bubble blows apart today or down the road, either way, hard assets such as real estate as well as bitcoin, gold, and silver will all continue to benefit. As rates go lower and debt piles up, the first time the Federal Reserve hikes rates may be the pin that blows the bubble apart. From 1933-1936, rates were at 0%. The Fed then hiked rates which sent the Dow Industrials down about -50% over the next several months. The fierce macroeconomic instability together with skyrocketing populism pushed the planet into World War II. As shown in a chart I will include [the chart below], from 1942 to 1945, the economy and the markets were classically war-driven as governments around the world both borrowed heavily by printing significant sums of money. This was stimulative to employment, particularly when it came to any war-related job. The stock market consequently rallied from 1942-1945.

Interest rates remained at 0% until 1942 when they were only slightly raised then kept near record low levels from 1942-1948. The U.S. being the victor was able to pay down its massive debt in the ensuing years that it had generated during the war as a period of high growth for the U.S. occurred over the next decade.

This begs the question whether we will see a major military war between the two superpowers, the U.S. and China since today's world rhymes a bit with pre-World War II times. Populism is at record levels. Debt as well. Major wars are economic in nature thus a major trade war could turn military at some point.

Four possible scenarios:

a) The trade war escalates further dampening global growth which spurs central banks to continue to print. This causes a major devaluation of the U.S. dollar among other fiat currencies. The price of hard assets shoot higher as more fiat would be required to buy real estate, stocks, bitcoin, precious metals, and collectibles. Tokenized assets which are a new asset class will also benefit.

b) The trade war ceases which helps spur growth. Trump's pro-business policies together with exponentially growing technologies help the U.S. reduce its debt. The Federal Reserve is able to start raising rates. The price of hard assets move higher as growth recovers. Real estate, stocks, bitcoin, precious metals, collectibles, and tokenized assets all benefit.

c) The trade war ceases which helps growth but only to where growth was before the trade war began. Trump's pro-business policies together with exponentially growing technologies are insufficient to help the U.S. reduce its debt. The Federal Reserve has no choice but to continue to lower rates. This causes a major devaluation of the U.S. dollar among other fiat currencies. The price of hard assets shoot higher as more fiat would be required to buy real estate, stocks, bitcoin, precious metals, collectibles, and tokenized assets.

d) The trade war turns into a military war. Huge levels of debt are required to finance the war. This causes a major devaluation of the U.S. dollar among other fiat currencies. Perhaps after the devaluation, the victor would be able to pay down its debt much as the U.S. did after World War II. Nevertheless, the price of hard assets would shoot higher after the devaluation as more fiat would be required to buy real estate, stocks, bitcoin, precious metals, collectibles, and tokenized assets.

Bitcoin's Superior Risk/Reward: So in all four scenarios, traditional and tokenized hard assets benefit as well as bitcoin but based on historical price trajectories, bitcoin by far stands the tallest. That said, it could be said that tokenized hard assets whose underlying value is tied to the hard asset such as real estate would represent solid reward without the volatility of bitcoin. The underlying asset can reap capital gains and yields as the asset price increases and the debasement of fiat continues. There are a number of companies such as HanseCoin that are tokenizing securities which represents the next storehold of wealth in a world of fiat debasement and negatively yielding debt. Bitcoin for the intrepid, tokenized hard assets for the more conservative. Both have their place as sound options.

Caveats

Keep in mind that bitcoin typically corrects between -28% to -42% during bitcoin bull markets and far greater during bear markets. That said, we are firmly in a bitcoin bull market which should continue until bitcoin has a massive upside move of typically 10-fold or greater as it has done each time since its creation in 2009. Stocks can also suffer material losses. Prior to the U.S. entering the war in 1942 suffered as the Dow lost -41.7% between 1939 and early 1942 as shown below. But this was due to the major world war that began in 1939. In today's world, should a major war begin, it would most likely involve the U.S. and China thus the amount of capital required to finance such an undertaking would, once again, benefit hard assets including stocks.

That said, such an escalation of the trade war, regardless of whether it turned into a military war, would dampen growth thus would put much pressure on stocks. But QEndless would create the safety net, thus it is likely that this big stock market bull run that began in 2009 will continue albeit with sharp corrections along the way as we have observed a number of -20% corrections in the major averages over the last decade. Always keep your stops tight.