Note, above I say roughly 3-times because some 3x ETFs have slight variations against the NASDAQ Composite. For example, TQQQ has a slightly better risk/reward profile than TYH, but TQQQ did not exist when we started tracking the model's performance against a 3x ETF in 2009 that roughly approximated the NASDAQ Composite, so we went with TYH.

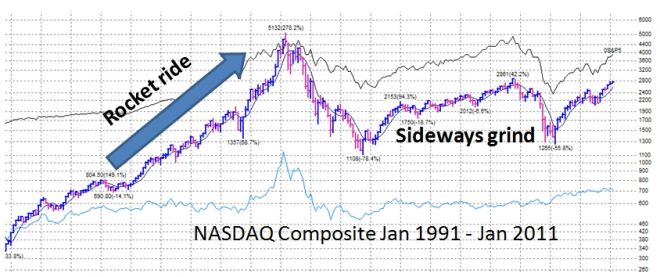

The last decade has been more challenging as it represented the top of the market in March 2000, the bursting of the bubble, then the sideways, reluctantly grinding rallies of 2004-2007.

For Jan 2000 - Dec 2010, the model's total returns using NASDAQ Composite (1x ETF QQQQ is a good proxy) were +741.1% vs NASDAQ Composite buy-and-hold of -34.8%. This is an annualized return of +21.4%/year using 1x ETF QQQQ, or +64.2%/year using a 3x ETF such as TYH or TQQQ, both which make good proxies to the NASDAQ Composite. While +21.4%/year is under the model's returns from 1974-present of 33.1%, it still is one of the best returns achieved timing the market in the last 10 years. Compare it to IBD, Decision Moose, Timing Cube, and other notable timing sites.