FAQs Frequently Asked Questions

Crypto Report

How do you trade cryptocurrencies which trade differently than stocks?

Q: I am familiar with Bill O'Neil's way of adding to his winning stocks as price pulls back to a moving average or builds a new base. But with cryptos it seems they consolidate for much shorter times at times. From your experience several years ago when you had huge crypto gains did you add on shorter consolidations, pullbacks to moving averages, or did you wait for CANSLIM type bases to form before you added to your winning coins?

A: Crypto trades differently so my rules are different. What works for me wont necessarily work for another since risk profiles are unique. I use various moving averages to time entries and exits. I also use various technical indicators such as MACD and O'Neil's RS as well as general price guidance from BTC and ETH since these two are the leaders and dictate general market direction for altcoins.

Portfolio management in terms of % exposure is essential. The whole is greater than the sum of the parts so if I'm holding a dozen cryptocurrencies, my exposure to each is dictated by its price action, volatility, RS, and overall % invested. If I see BTC or ETH launching into an uptrend, I will buy those alts with top fundamentals and technicals. I will scale back if funding fees are getting overheated which is a mark of potential market exhaustion due to extended prices, or if there is the possibility of tightening as the Fed warned in late 2021 of which we apprised members.

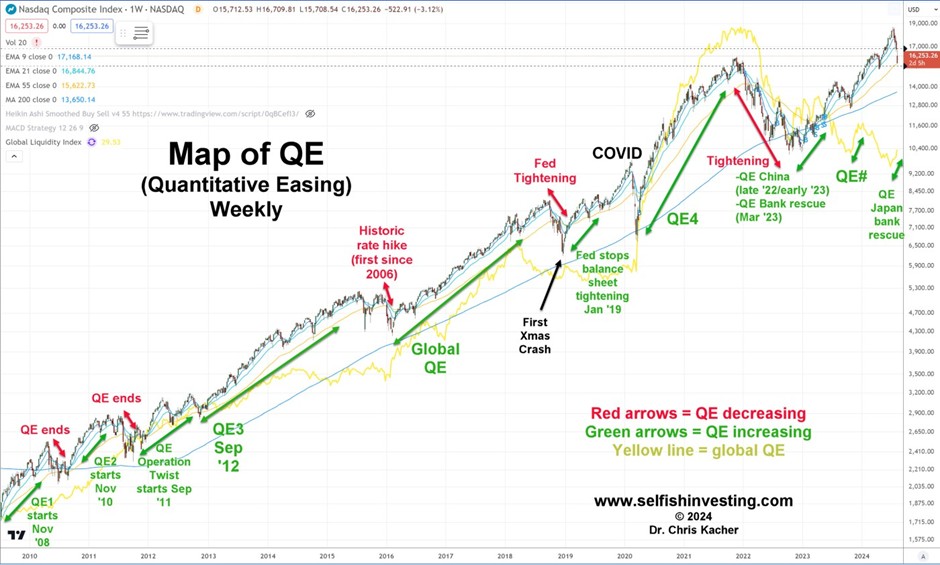

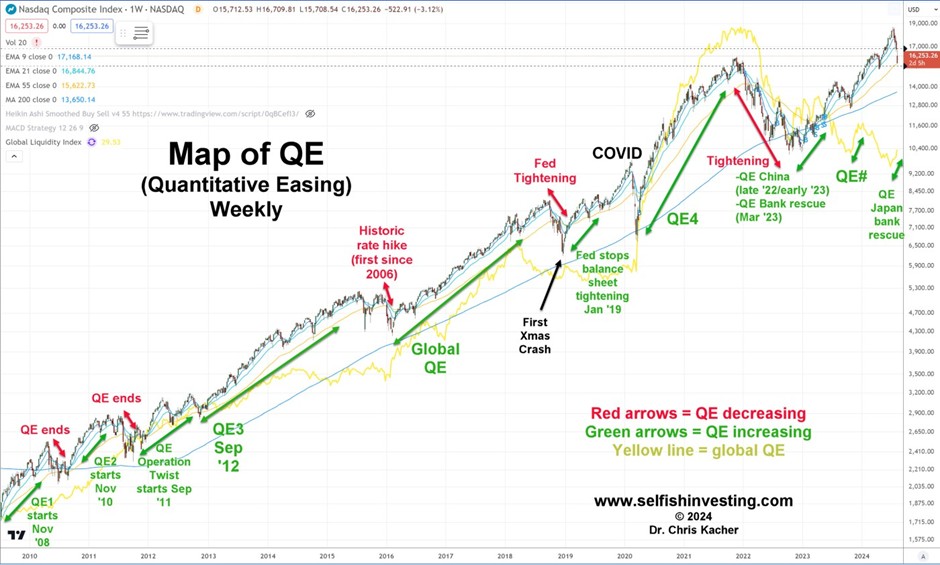

In this inflation megatrend market, quantitative easing is increasing most of the time. This bodes well for stocks and cryptocurrencies out to at least the next few years. Indeed, BTC was in a weak bull market for most of 2023 and 2024, with only a few months of a strong uptrend due to QE in early and late 2023, interest rate cuts in late 2024, and anticipation in late 2023 then launch in early 2024 of the Bitcoin spot ETF. Bitcoin only recently broke out of its multi-month consolidation which was then spurred by the Trump victory.

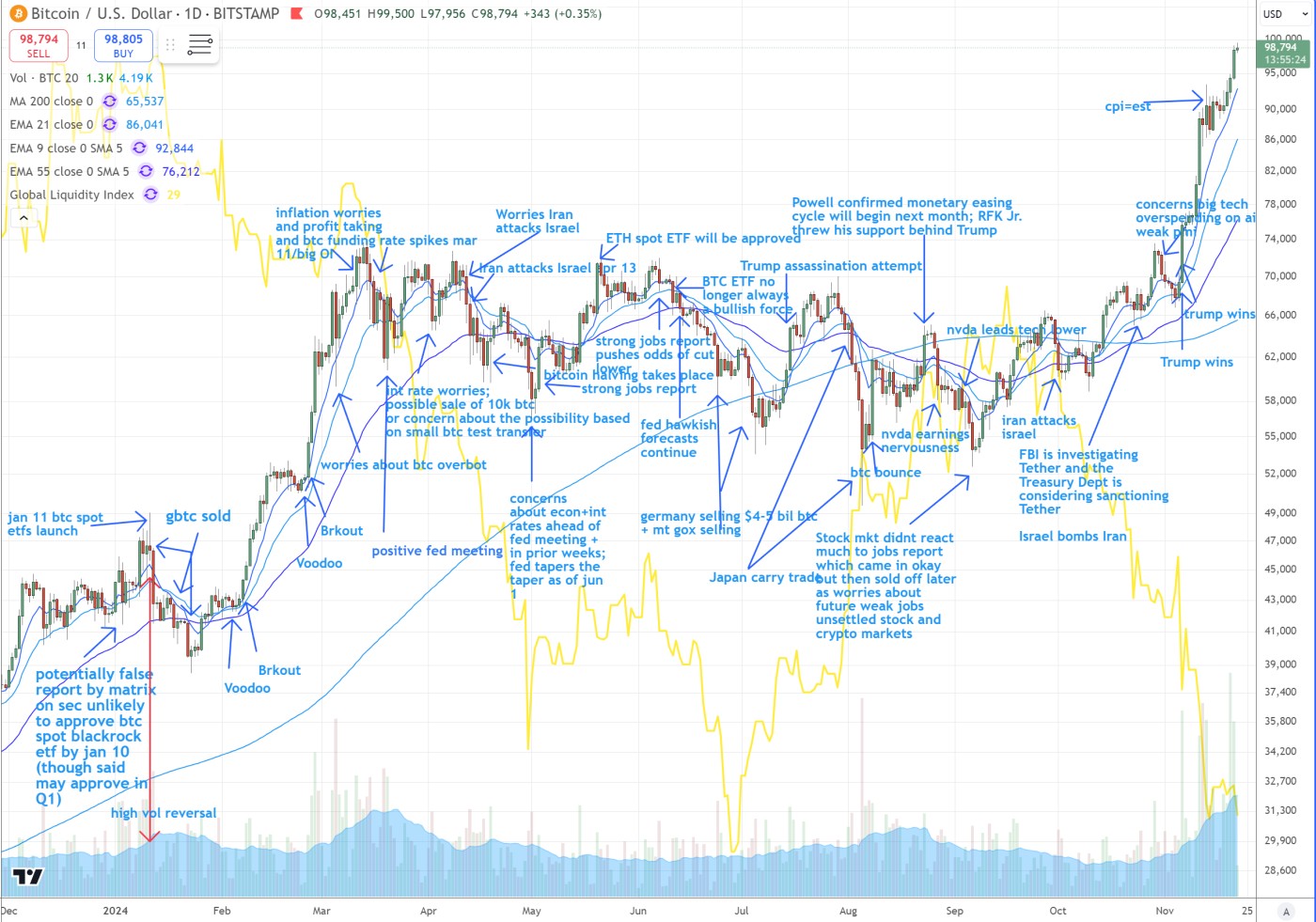

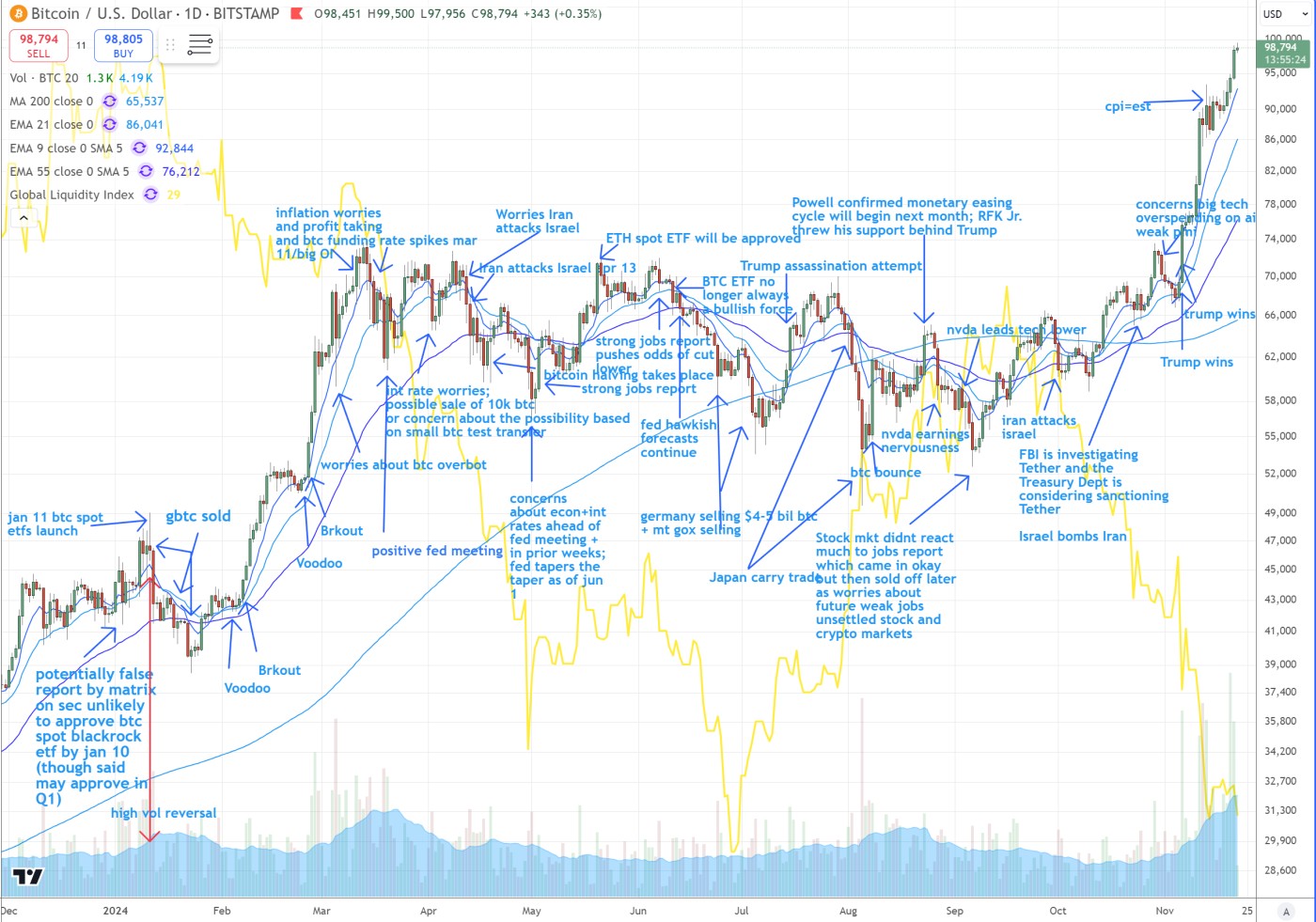

Here's a snapshot of Bitcoin with notes I make along the way:

With the inflation tailwind, vehicles such as TECL are no-brainers to buy-and-hold but even greater returns can be made through my market timing which uses macro along with my chart eye.

A: Crypto trades differently so my rules are different. What works for me wont necessarily work for another since risk profiles are unique. I use various moving averages to time entries and exits. I also use various technical indicators such as MACD and O'Neil's RS as well as general price guidance from BTC and ETH since these two are the leaders and dictate general market direction for altcoins.

Portfolio management in terms of % exposure is essential. The whole is greater than the sum of the parts so if I'm holding a dozen cryptocurrencies, my exposure to each is dictated by its price action, volatility, RS, and overall % invested. If I see BTC or ETH launching into an uptrend, I will buy those alts with top fundamentals and technicals. I will scale back if funding fees are getting overheated which is a mark of potential market exhaustion due to extended prices, or if there is the possibility of tightening as the Fed warned in late 2021 of which we apprised members.

In this inflation megatrend market, quantitative easing is increasing most of the time. This bodes well for stocks and cryptocurrencies out to at least the next few years. Indeed, BTC was in a weak bull market for most of 2023 and 2024, with only a few months of a strong uptrend due to QE in early and late 2023, interest rate cuts in late 2024, and anticipation in late 2023 then launch in early 2024 of the Bitcoin spot ETF. Bitcoin only recently broke out of its multi-month consolidation which was then spurred by the Trump victory.

Here's a snapshot of Bitcoin with notes I make along the way:

With the inflation tailwind, vehicles such as TECL are no-brainers to buy-and-hold but even greater returns can be made through my market timing which uses macro along with my chart eye.

| First published: | 22 Nov 2024 |

| Last updated: | 22 Nov 2024 |