FAQs Frequently Asked Questions

Q: Did you start out being pretty calm about huge drawdowns (being a natural) or did you get better about it as you become a better trader? I started following your Market Direction Model service starting this year using 3x ETFs. Instead of being up 3% on the first trade, I was actually down 1.2% due to timing and slippage etc. I am also aware of the possibly large drawdowns and I made up my mind initially that I will do my best to handle them psychologically. I keep telling myself that eventually I will catch a trend and it will cover all the losses and then some. However it is a lot harder to do when you have your hard earned $ on the line. It was good to hear about you [Dr K] having a drawdown of nearly 50% during part of 1999 in your own trading account, not losing sleep, then finishing the year up hugely in both your own and the much larger institutional firm account. It's a lesson in not losing one's head just because they are losing money. I can't say I get very much sleep when I lose money but I know I will get better about it eventually. :) You have a list of books that you recommend. Is there one on the list that focus more on the psychology of trading that you think I should read first? Also I know you guys are coming out with a new book later on. When will it be available? Thanks.

A: There's the saying of selling down to your sleeping point. I would add that the amount of capital one risks in the markets should be capital one is willing to lose at least half, in the event of a 2008 crash scenario or simply a very bad drawdown. If one can imagine their account halved, and be psychologically okay with that, then should such occur, one is likely to act in a strategically sound manner should it occur instead of losing their head.

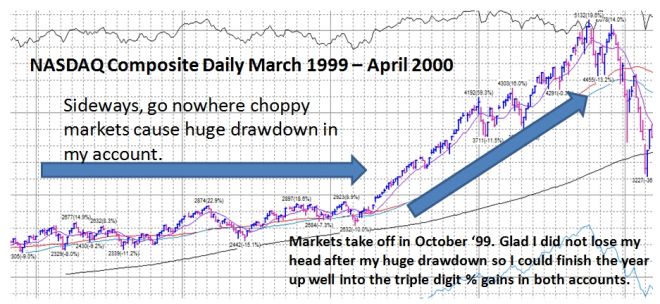

In the early 1990s, I took large drawdowns in stride because I knew why I was getting them, and it was what I call educational tuition. As my trading continued to improve, my drawdowns diminished. Then the market handed me something it's never done before- a highly volatile, sideways, go nowhere market from March 1999 - October 1999.

Note, the largest drawdown in the Market Direction Model of -15.7% also occurred during this period. While the model's long term returns are +33.1%/year, which would be +99.3%/year if using a 3x ETF that closely mirrors the NASDAQ Composite such as the TYH or TQQQ, a drawdown using a 3x ETF would have been -15.7% x 3 = -47.1% which is more than most can take and therefore one is liable to abandon the model at the worst moment.

Virtually all top traders have experienced their share of huge drawdowns (-50% or greater) and include Gil Morales, William O'Neil, John Henry, Ed Seykota, and Bill Dunn. The difference is that all recovered relatively quickly during the next opportunity, and thus their long term track records kept their glow.

Over the years, as long as I know WHY I'm making or losing money, I dont lose sleep. That said, I started getting very nervous after the end of 1999, as the massive run up in biotechs in the first quarter of 2000 allowed me to continue to make big money. It didnt make sense. I stopped understanding why I was making money. Something seemed wrong. Then March 2000 came along, and the market topped. Both Gil and I were out of the market 3 days from the March top.

One of the best books I've read on investment psychology that is on my reading list is Market Wizards and New Market Wizards by Jack Schwager. Also, go to www.tradingtribe.com, the site run by futures market wizard Ed Seykota. Seykota is a huge shining light when it comes to trading psychology.

Too soon to say when we will start writing our next book. I would imagine the process will begin sometime later this year [2011].

We hope to see you in New York City at Traders Expo when we give our talk on February 21, 2011 1:30pm - 2:30pm. Register here: http://www.moneyshow.com/tradeshow/new_york/traders_Expo/workshop_details.asp?wid=645168CC11A9400BB007CCAD0D4CE078&scode=020863

| First published: | 2 Feb 2011 |

| Last updated: | 16 Feb 2011 |