Market Lab Report / Dr. K's Crypto-Corner

by Dr. Chris Kacher

The (R)Evolution Will Not Be Centralized™

PLUS

This was the week of gaps higher on strong earnings. FB is pulling back constructively after gapping higher. AAPL is now extended though we had mentioned prior entry points. AMZN pulled back nicely after gapping higher. MSFT also pulled back into a lower risk entry point after gapping higher. GOOGL gapped lower and is currently getting support at its 50-dma. GOOGL's ad revenues suffered as companies spent less but its R&D remains at full strength in exponentially growing areas including AI and VR. The same goes for the others. The 7-week rule remains in effect. There was some confusion about the report on AAPL where I wrote the 7-week rule has worked well. If you look at a chart of AAPL, you will see you would have stayed in its entire move since April up until it violated its 10-dma on July 24. You would then re-enter your position on the buyable gap up which we announced before the open.

Manipulated Economic Statistics

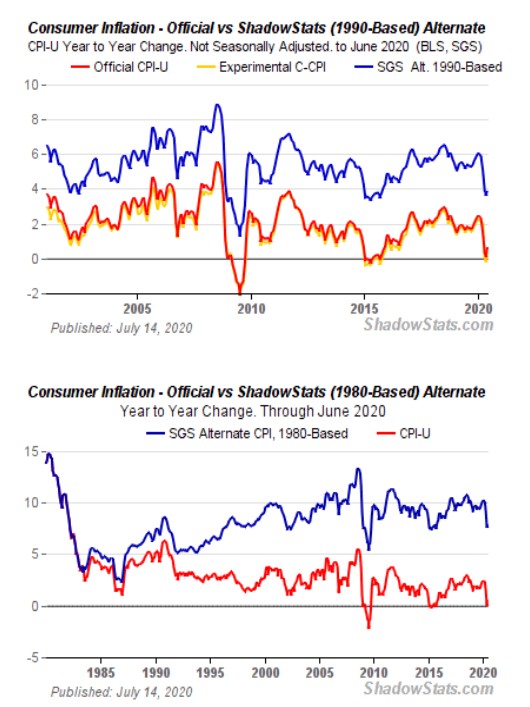

We have spoken numerous times about how various government statistics are heavily biased. One such statistic is the CPI. The Fed revised its inflation target to 4% from 2%. Meanwhile, as shown by Shadowstats, the real rate of inflation has been closer to 10% if using the way inflation was gauged in the 1980s. Over the last decade, prices of basics such as food and rent certainly have moved higher than the official inflation rate of below 2% annually. With the Fed's revision to 4%, think of what this will do to the real rate of inflation, debt, and interest rates. Yields on the 10- and 30-year bonds are looking to retest all-time lows. Is it any surprise bitcoin has performed as it has?

Fundamentals or Funnymentals?

Q: I use Market Smith for their rating system and other information. If I find a group of "like" stocks. Often their chart patterns are similar. I try to buy the leader. Market Smith is useful, but sometimes the stock is too new to trading for this service to be of much value. I try searching using TDAmeritrade, Charles Schwab, or Fidelity's database, but I find these to be of little use. I will go to the individual company web sites. Usually they are carefully crafted to put themselves in the best light. Also I may not have any knowledge of the company's specialty.

A: Fundamentals have less meaning in this QE environment, but they still hold value as long as you keep things in context. It is better to run stock screens looking for favorable technical action and then work through any thematic factors that could drive a price move for the industry group. As one example, members were sent a report on SPCE even though it had no earnings but the space travel group was and remains a hot topic.

Within a group, it is important to understand a stock relative to its peers which enables one to place its fundamentals in context within its industry group. This is not always a simple matter. Accelerating sales and earnings with numbers ahead of expectations with revised guidance higher are still of value but less so than in prior non-QE markets. A stock often gaps higher on such news, though is not necessarily automatically buyable. It comes down to the quality of the revised guidance and of course, a low risk entry point. Keeping risk below 2-3% on a trade is ideal in this era of QE. That said, if a stock checks all the boxes for both fundamentals and technicals, one may buy a smaller position at a higher level of risk. What is small or large to an individual depends on their personal risk tolerance which we have discussed numerous times in our books and articles.

As for other fundamental factors, a stock that has been in the red then has its first quarter of genuinely positive earnings is a notable event, but one must determine if this was just a one-off exception as some companies then go back to negative earnings for a number of quarters.

Certain industry groups such as some biotech companies have zero earnings so other metrics such as drug pipeline and approvals is of greater value. Sales acceleration with higher revised sales guidance is also of value in such cases.

Naturally, the quality of the team leaders along with the company's potential to dominate its market or market niche are obviously important. Covid is an accelerant in both directions. It creates far greater government rule over individuals in terms of economic lockdowns, house arrests, and various forms of quarantine. New laws that infringe on personal rights get enacted. But this then spurs industry groups such as healthcare, cloud computing, cyber security, online businesses, and enterprise among others. With some technology companies growing at exponential speeds, change continues to accelerate.